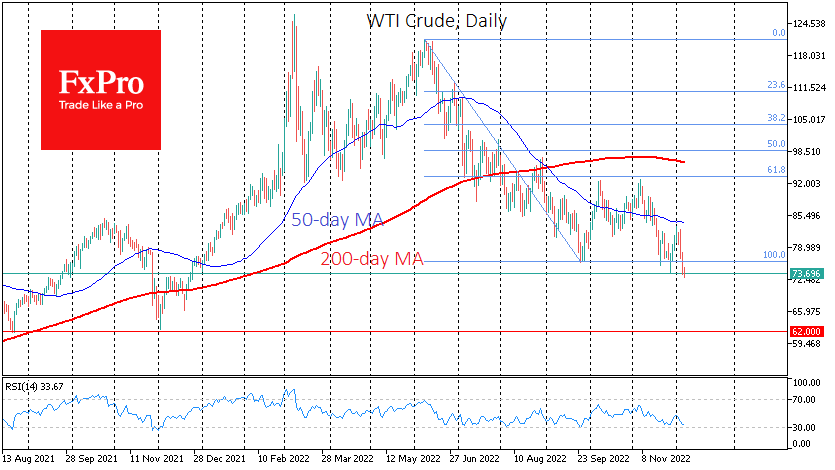

WTI crude is down to $73, while Brent is approaching $78, losing 2% since the start of the day and almost 10% since the beginning of the month. Despite rumours about possible quotas cut, OPEC+ keep them for another two months, leading the price to drop. We expect pressure on prices to persist soon, with prices likely to plunge into the $62-65 area.

Despite Russia’s warnings that the imposition of price caps on its oil from G7 and Australia will cause an uncontrollable price spike, the market reaction is quite the opposite. Oil always looks like a leveraged bet on the economic cycle, dropping sharply during the economic slowdown. In addition, the price cap did not cause an immediate supply shock while demand prospects have worsened due to the threat of recessions in the eurozone, the UK and the US in coming months.

Oil traders are not yet frightened by the risks of reducing the global oil supply. Experience with Russian gas substitution has been better than initially feared. For oil, there is also an expectation that the decline in Russian production will be smooth enough, allowing other producers to ramp up supply to increase their market share.

A purely technical view of the price dynamics suggests that the decline is far from over. Oil rewrote the September lows at the end of November and has updated them again today. This looks like a second downside momentum after the corrective pullback from the end of September to 61.8% of the first leg down from June to September. The downside target in this pattern is levelled at 161.8% of the actual move. This is close to $50 per barrel WTI in our case.

However, such an ambitious plan by the oil bears is worth breaking into several intermediate steps. The first support looks to be the $70 area, from which the US government has promised to resume buying oil for reserves. We still need to determine if these purchases will be unlimited, forming a firm ‘floor’ for the price.

The next, deeper support line appears to be the $62-65 area, where the oil turned from a decline to a rise in August and December last year. This is where prices could fall before the end of the year if the US and eurozone economies stop surprising with economic data and China continues to slow.

A plunge towards $50 is possible if the global economy is on the verge of a downturn and oil producers such as sanctioned Russia, Iran, and Venezuela can hold off cutting their production to supplement their budgets.

The FxPro Analyst Team