Oil prices rose on Wednesday on improving factory activity in China and drawdown in U.S. crude inventories, both indicating an economic recovery and rise in energy demand despite surging coronavirus infections around the world.

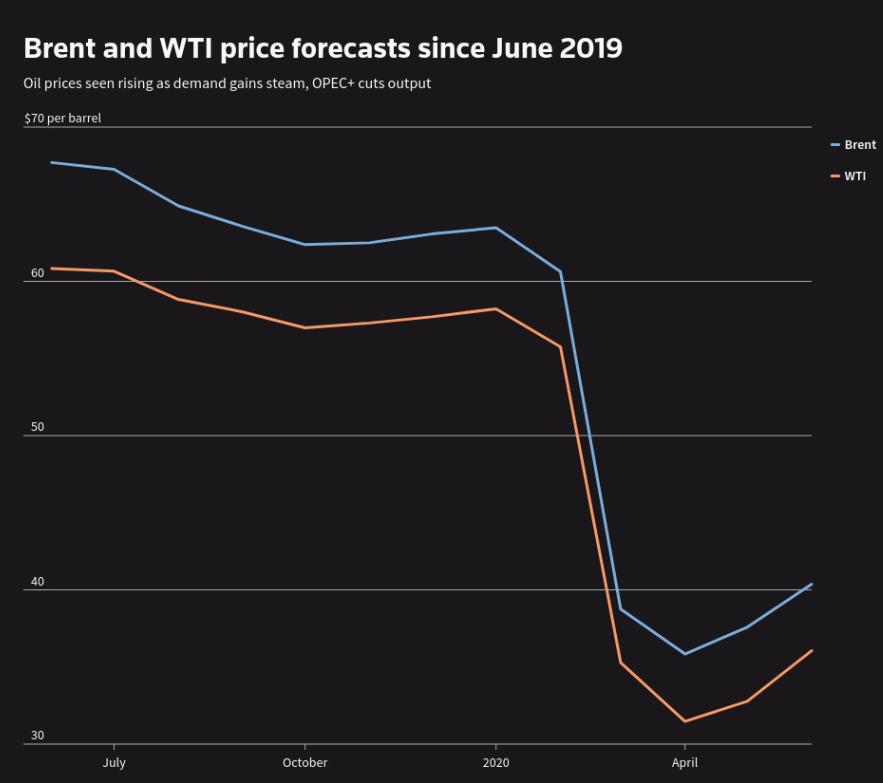

Brent crude was up 90 cents, or 2.2%, to $42.17 a barrel at 0811 GMT, and U.S. crude was up 90 cents, or 2.3%, at $40.17 a barrel. U.S. crude and gasoline stocks fell more than expected last week, while distillate inventories rose, data released by the American Petroleum Institute (API) late on Tuesday showed. “The crude numbers are clearly constructive, however, we will need to see what the more widely followed EIA numbers show,” ING said

Official inventory data from the U.S. Energy Information Administration (EIA) is due out later on Wednesday. Sentiment was also boosted by signs that China’s factories slowly gathered steam in June after the government lifted lockdown measures. The manufacturing purchasing managers’ index (PMI) rose to 51.2 last month, from May’s 50.7. The 50-mark separates growth from contraction on a monthly basis.

Also supporting prices was a drop in output from the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, following an agreement to curb supplies. “Although there is still the danger of demand outages in view of increased new cases of COVID-19, OPEC+ seems to have the market under control at the moment,” said Commerzbank analyst Eugen Weinberg. OPEC produced an average of 22.62 million barrels per day (bpd) in June, a Reuters survey found, down 1.92 million bpd from May’s revised figure. Top oil exporter Saudi Arabia may raise its August official selling price (OSP) for crude sold in Asia, hiking for a third straight month due to rising Middle East benchmarks and a rebound in Asian refining margins, industry sources said.

Oil rises on signs of economic recovery, ignoring surging infections, Reuters, Jul 1