Oil rose slightly on Monday as positive economic data supported prices, while a spike in coronavirus cases that could curb fuel demand in the United States limited gains. Brent crude was up 47 cents to $43.26 per barrel by 1:52 p.m. EDT (1752 GMT). U.S. West Texas Intermediate (WTI) crude was up 6 cents at $40.70.

“Energy is still correlating more to the coronavirus,” said Bob Yawger, director of energy futures at Mizuho in New York. “The coronavirus situation kills gasoline demand at the end of the day and if you don’t need the gasoline, you don’t need the crude oil to make it.” In the first five days of July, 16 states reported record increases in new cases of COVID-19, which has infected nearly 3 million Americans and killed more than 130,000, according to a Reuters tally.

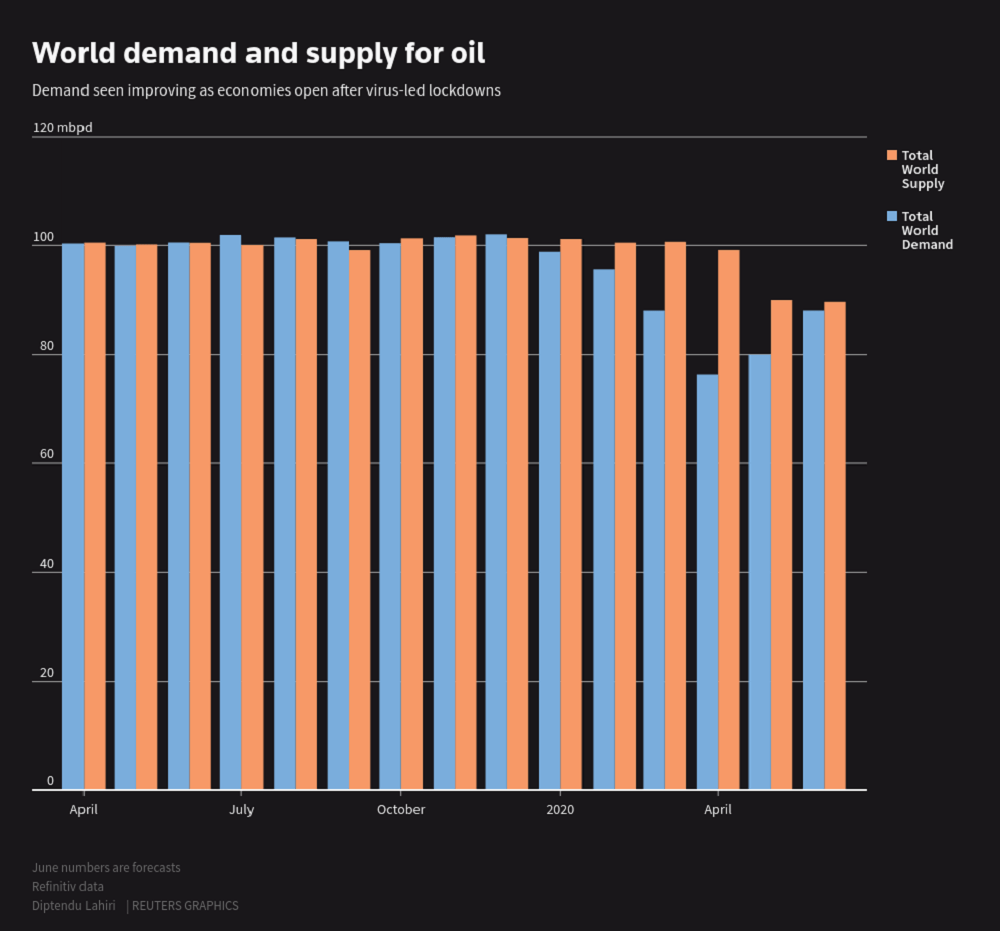

The implied volatility for Brent crude has dropped to its lowest since prices started collapsing in March as markets remain focused on tightening supplies. Production by the Organization of the Petroleum Exporting Countries (OPEC) has fallen to its lowest in decades. OPEC and other producers including Russia, collectively known as OPEC+, have agreed to lower output by a record 9.7 million barrels per day (bpd) for a third month in July. Saudi Arabia’s state oil producer Aramco has increased official selling prices (OSPs) for its crude to Asia by $1 a barrel in August, and raised the OSPs for almost all grades to Europe and the United States.

Oil rises on economic data but spike in U.S. virus cases caps gains, Reuters, Jul 6