Oil prices rose for a fourth day in a row on Friday, putting crude on track for a weekly gain of about 10%, after Saudi Arabia pressed allies to stick to production quotas and banks including Goldman Sachs predicted a supply deficit.

Brent crude was up 18 cents at $43.48 a barrel by 0756 GMT while U.S. oil futures rose 17 cents to $41.14. Both contracts are set for their strongest weekly gains since early June after Hurricane Sally cut U.S. production and OPEC and its allies laid out steps to address market weakness. Goldman Sachs predicted the market would be in a deficit of 3 million barrels per day (bpd) by the fourth quarter and reiterated its target for Brent to reach $49 by the end of the year and $65 by the third quarter of 2021.

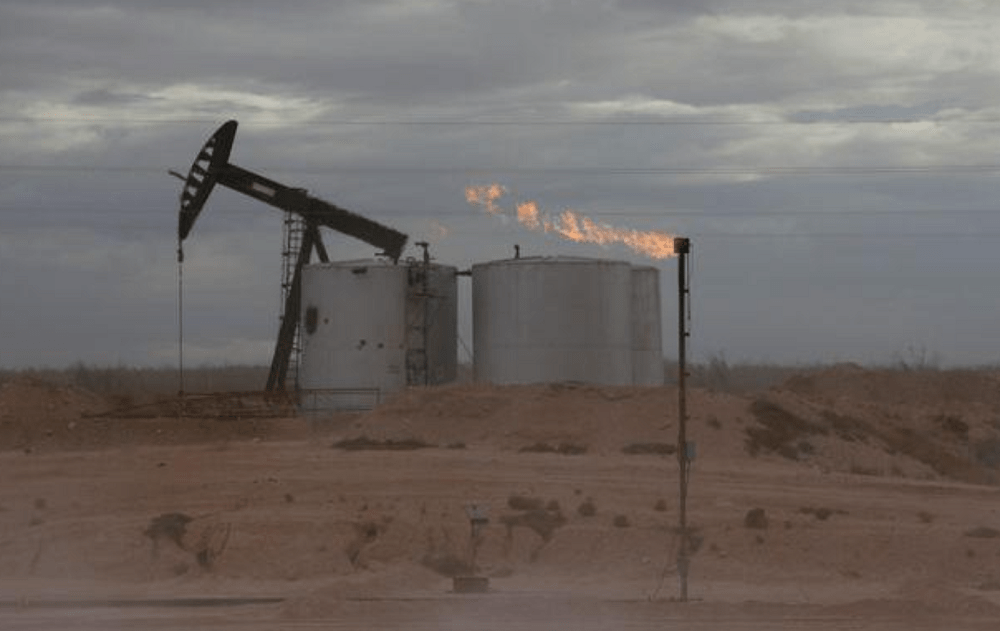

The Organization of the Petroleum Exporting Countries (OPEC) and other producers in OPEC+ are cutting 7.7 million bpd of output and the group stressed at a meeting on Thursday that it would take action against members not complying with the deal. “We think (OPEC+) will put on hold plans to taper the cut down to 5.8 million bpd. when the entire group convenes again in December,” RBC analysts said. In the Gulf of Mexico, U.S. offshore drillers and exporters began a clear-up on Thursday after Hurricane Sally weakened to a depression and started rebooting idle rigs following their closure for five days.

Oil rises after OPEC warns members to stick to quotas, Reuters, Sep 18