Oil ended the week up over 4%, continuing the rebound that began on 9 April following a strong rally due to tariff postponement. Prices managed to recover from 4-year lows by more than 16%, which is impressive and brings the market closer to bullish territory. However, the situation currently appears more like a rebound before a possible further decline than a reliable reversal.

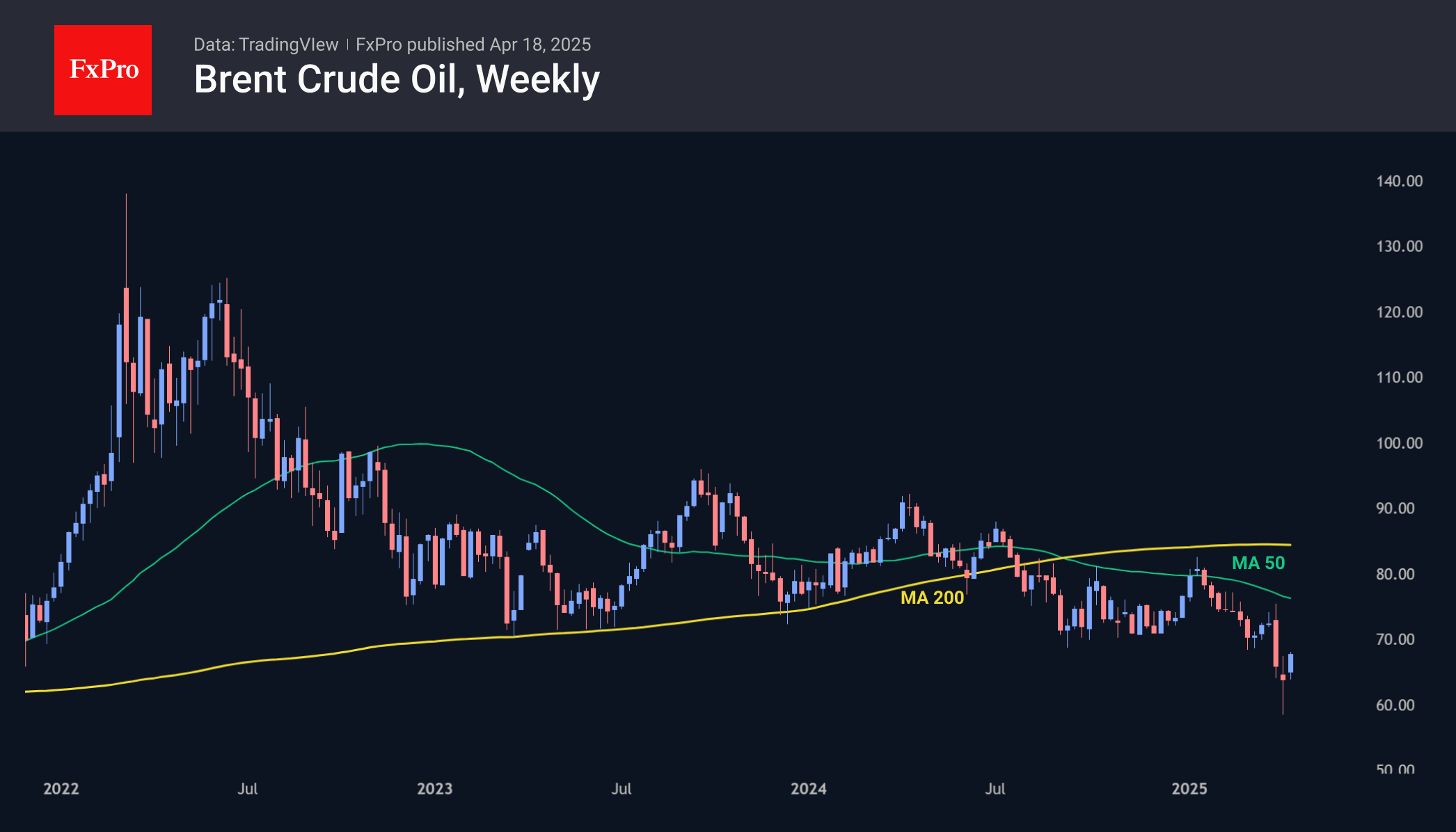

Brent remains below the key level of $71, which has served as strong support for two years and may now become equally strong resistance. WTI is similarly holding below $66, where buying has stabilised the market for almost four consecutive years, preventing it from consolidating below this level.

The April sell-off was initially triggered by alarmist concerns over tariff announcements but was also fuelled by a shift in OPEC+ tactics. The cartel raised production quotas and lowered selling prices for Asia, shifting the focus from price-targeting to the competition for market share.

Curiously, this occurs at a time when U.S. production exhibits a weakening trend. Average production rates have fallen below 13.5 million bpd after 13.6 million bpd were observed for most of March. The oil rig count has decreased to 480-481 over the past fortnight, compared to 486 in the previous month and a half. This figure has plateaued since last July, and at current or even lower prices, a further decline is expected as upstream investment becomes less attractive.

At present levels, oil has room for a slight 2-3% rise, but a firm foothold above $66 for WTI and $71 for Brent would signal bullish sentiment. Only a sustained move above the 50-week moving average, currently at $72 for WTI and $76 for Brent, will provide the final confirmation of the bull market’s return.

Bearish factors remain robust: alongside the longer-term technical picture, markets are under pressure from the shock of tariff wars, which is suppressing business activity and slowing energy consumption growth.

The FxPro Analyst Team