Global markets were again under pressure at the beginning of the new week, with the oil situation looking particularly worrying. Earlier this month, it performed “above the market”, staying on the sidelines while the overall demand for risk declined.

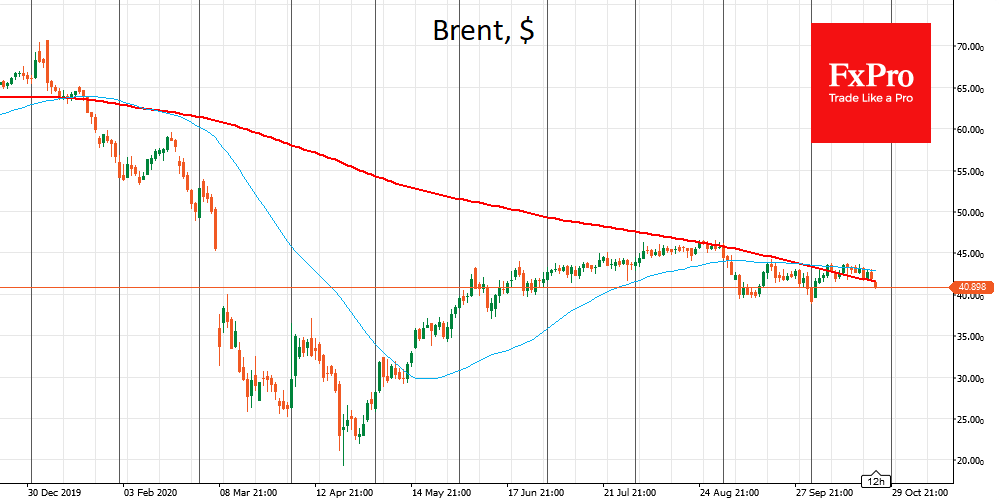

Since Friday, however, Brent has fallen 4.2% to $41.1 from levels around $43. WTI has returned below $39 for the first time since the 5th of October. The technical picture and investor sentiment suggests that the negative momentum may continue in the coming days.

News from Libya put pressure on the cost of a barrel on Friday. Monday’s announcement of the recovery on a large oilfield contributed to the negative sentiment.

Libya could restore its production to 1 million barrels per day within a month after the industry had almost completely shut down in previous months. These forecasts threaten to disrupt an already fragile supply and demand balance.

Separately from this, oil companies continue to recover drilling activity. The data released on Friday showed an increase in the number of oil drilling rigs to 211, the highest since May. Production trends tend to trail six months behind drilling.

This is probably why we have not yet seen reliable signs of recovery in actual production. Earlier last week it was reported that US production fell to 9.9 million barrels per day, with some of this decline due to hurricanes.

However, let’s suppose we have a repeat of the model that we saw in 2009 and 2016. In that case, America will continue to increase the number of rigs in operation. This recovery could last another year.

Increased production from the Americans could further strengthen the US global market position, and OPEC+, as the market balancer, could lose its share again. As its member countries receive the lion’s share of revenues from energy exports, OPEC+ is unlikely to go for a cut in production, which promises a new round of pressure on oil in an attempt to stay afloat.

This means that OPEC+ will continue to oppose a new tightening of quotas, which could lead to a recovery in oil volatility.

On the demand side, problems are again increasing. The sharp increase in the number of illnesses in Europe is forcing governments to introduce curfews and reinstate partial restrictions on movement, which could put pressure on consumer demand.

However, it will not be as strong as it was in the spring, because industrial companies have not stopped, and the pressure is only in the service sector. The technical picture of Brent is now quite alarming, as oil is again traded below the 200- and 50-day average.

The last time we saw these lines converge in January, the price fell below them, after which quotations lost 70% over the next three months. Even a half-reduction in price this time will bring Brent back dangerously close to the lows of April.

The FxPro Analyst Team