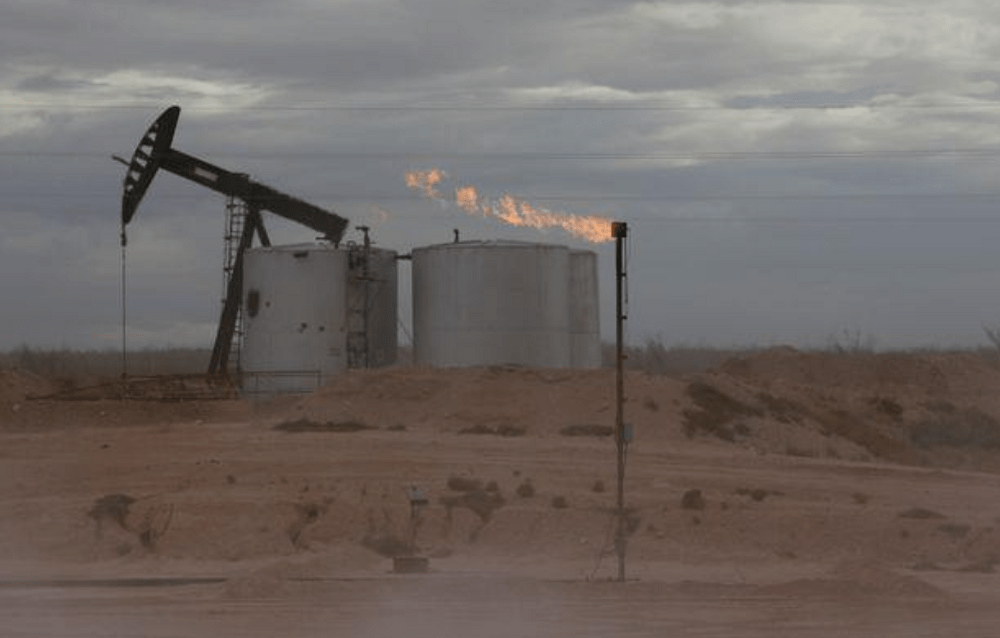

Oil prices fell on Monday on the potential return of output from Libya as rising coronavirus cases also added to worries about global demand, although a tropical storm heading for the U.S. Gulf of Mexico limited losses. Brent crude was down 33 cents, or 0.8%, at $42.82 a barrel by 0645 GMT, while U.S. crude was down 38 cents, or 0.9%, to $40.73 a barrel.

Workers at Libya’s major Sharara field have restarted operations, two engineers working there said, after National Oil Corporation announced a partial lifting of force majeure. But it was still unclear when production might restart.

Meanwhile, Royal Dutch Shell Plc halted some oil production and began evacuating workers from a U.S. Gulf of Mexico platform, the company said on Saturday. Tropical Storm Beta was predicted to bring 1 foot (30 centimetres) of rain to parts of coastal Texas and Louisiana as the 23rd named storm of this year’s Atlantic hurricane season moves ashore on Monday night, the National Hurricane Center said.

Oil and gas producers had been restarting their offshore operations over the weekend after being disrupted by Hurricane Sally. Some 17% of U.S. Gulf of Mexico offshore oil production and nearly 13% of natural gas output went offline on Saturday in the face of Sally’s waves and winds.

Oil prices slip on potential return of Libyan output; Gulf storm supports, Reuters, Sep 21