The price of oil has stabilised at $93 per barrel for WTI and $95 for Brent, after falling by more than a quarter from March 8th. Buyers’ support came on a correction to levels at the beginning of this month, completely cutting off the speculative upside due to events in Europe and fears of a supply stoppage.

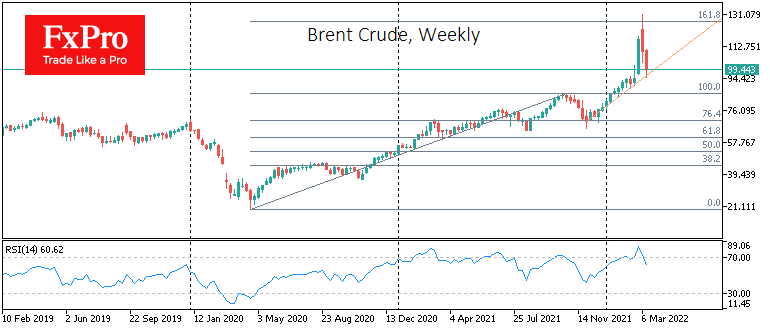

Due to correction over the past week, the price has returned to the uptrend support line formed in December. The market is pricing as if there was no military conflict in Europe and fears of a total oil shortage due to the embargo on Russian oil. Initially, this uptrend had formed on evidence that the omicron strain wave was not followed by lockdowns, so demand continues to rise gradually.

Interestingly, neither a 350% increase in the price per barrel in precisely two years, a 17% fall in commercial reserves over one year, nor the need to compensate for oil from Russia contributes to US production growth.

US average daily production has held steady at 11.6m b/d for the last six weeks, which is close to the average over the previous six months.

The observed increase in drilling activity only helps cover the drop in production from depleted fields. However, businesses in the USA remain reluctant to invest in production increases. This is probably due to the ongoing tough ESG agenda, which is holding back investment in an industry that was producing over 13 million BPD in early 2020. Without the coronavirus, it would have reached 14 million BPD by the end of that year.

On the other hand, the US and global economies are experiencing an evident shock to energy prices, causing economic growth to slow and oil demand to fall.

This situation sets the oil price in the coming days or weeks to find a balance in the $85-100 range. The lower bound is a multi-year turning point for the price in this range, which has now become a meaningful support level. At the same time, the upper bound is a psychologically crucial round level, the capture of which made the oil market wild in early March.

The FxPro Analyst Team