Crude oil has added for the fourth consecutive trading session. However, the rise in quotes has been tempered by comments from the German economy minister, claiming that the EU could agree on an embargo on Russian oil within days.

However, movements in oil have become more subdued not only because the embargo topic has been discussed for many weeks, having ceased to be a fresh driver.

The fundamental balancing act for the market is the continued sales from the strategic oil reserve of the USA and several other countries. In addition, China is showing a stronger-than-forecast slowdown due to strict anti-viral restrictions. The global economy is experiencing a slowdown due to high prices and disrupted supply chains.

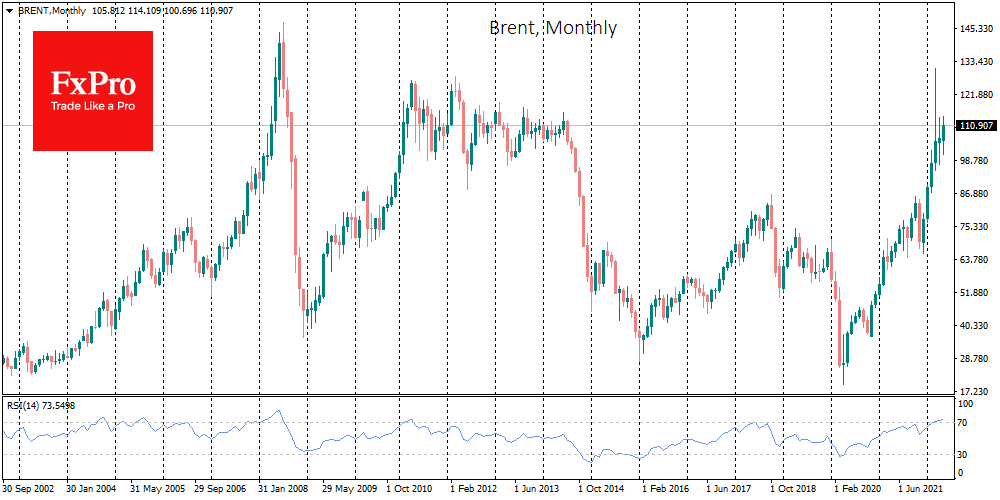

Technically oil remains in a medium-term upward range. Bulls in WTI and Brent continue to buy oil on declines towards the 50-day average.

The oil price is now at levels near $110 for WTI and $111 for Brent, near the peak area of the last two months. It will take a meaningful bullish driver for quotes to manage to consolidate above this area this time.

If the resistance is broken through, we might see oil take to the new horizon with the potential of rapid appreciation up to $120 or even $130 in a couple of weeks.

This looks a lot like what we saw in 2009-2010 when a similar post-crisis recovery in prices started to slow economies and inflation, locking oil into a three-and-a-half-year $100-130 range and eventually crawling back towards the lower end of that range as production capacity recovers.

The FxPro Analyst Team