WTI oil is back above $70 on Monday, having gained more than 2% since the start of the day. Today’s short-term impulse is a halt in exports from Iraqi Kurdistan via Turkey. The latter move could be part of a broader oil recovery after being extensively oversold.

Oil started last week with a final collapse below $65, its lowest since November 2021. The sell-off in oil has stopped at technically critical levels, from where buyers’ interest in oil has returned. This disposition sets the stage for at least a medium-term rebound. A more optimistic scenario suggests a subsequent multi-month rally in quotations.

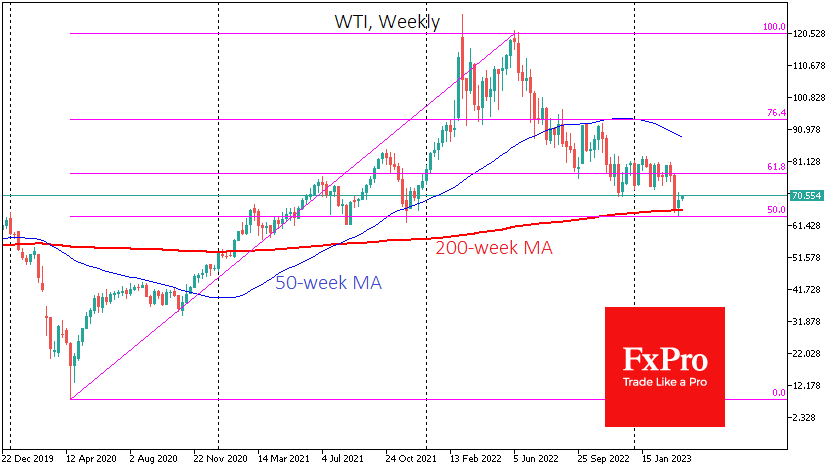

The oil bulls managed to return the prices to the area above the 200-week average. This level has been a vital cycle indicator in previous years. In 2019, this level acted as significant support. In 2020, a dip under this line was an early indicator of a subsequent collapse. A strong surpass of this line in early 2021 was a harbinger of more than double-digit price increases in the following year.

So far, there are more indications that oil has managed to stay above that level without plunging into free-fall as it did in 2020 and 2014 when going under the 200-week average intensified selling rather than attracting buyers as it did this time.

Zooming into the daily timeframes shows us a recovery of the Relative Strength Index from the oversold territory, which also argues for a short-term bounce.

It is also noteworthy that oil managed to rise last week despite the news from the US. On Wednesday, EIA reported that production returned to 12.3M BPD, the region of February’s highs. Crude Inventories rose for a second week, 16.4% above levels the same week a year earlier. On Friday evening, Baker Hughes noted an increase in working rigs, but that did not prevent oil from closing firmly.

The rally to start this week supports a bullish reversal in oil. At the same time, the very tense macroeconomic backdrop (recession risks, high-interest rates) is forcing a break on the upside.

An important test of the sustainability of the bullish trend in oil is seen in the $73 area. This is the area of the local lows of the December-February trading range, from which the price pulled out during the March sell-off. A recovery above 73 would signal that we do not see a short-term corrective bounce but a new multi-month upward trend.

The FxPro Analyst Team