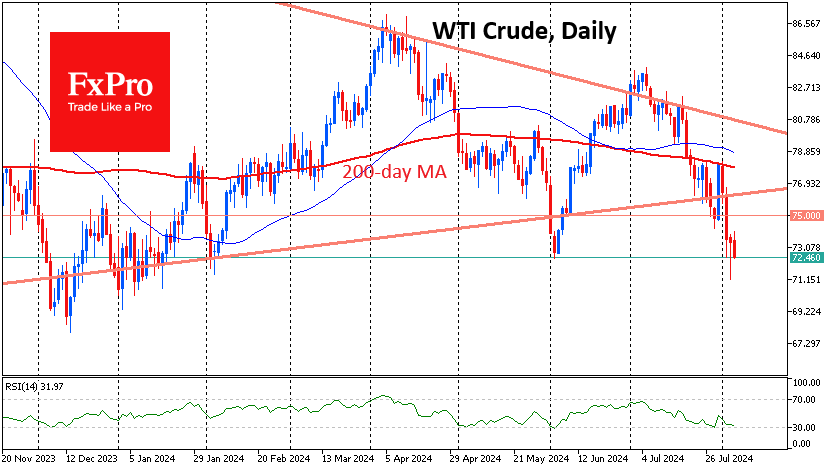

After starting Monday with a plunge of more than 3%, oil recovered almost all losses by the end of the day. However, as the price approached the $74 level, the balance of power shifted back to the sellers, and by mid-day on Tuesday, the price lost 2%, moving below $72.5.

The short-term technical picture in oil is clearly in favour of the bears. At the end of last month, the price fell sharply under the 200-day average, signalling a change of market regime. On the last trading day of July, there was an attempt to storm this level. However, this only made the bulls’ position even more desperate as it eventually confirmed the strength of resistance, after which the sell-off intensified with the start of August.

At current levels near $72.50, WTI crude oil is trading near localised lows at the start of June. A bounce from current levels could establish this as a solid support area. However, we see this as an alternative scenario, assuming further decline is the main scenario.

Oil has been under pressure since early July due to deteriorating macroeconomics, and this sentiment has only been reinforced by last week’s releases. Meanwhile, while commercial inventories have fallen over the past five weeks, they are only 1.5% below their level a year ago. Meanwhile, the strategic reserve has added over 8% y/y, and its replenishment may accelerate following the decline in prices.

On the tech analysis side, oil is under pressure after falling below the 200-week moving average, with the last dip occurring in January 2020. Further confirmation was the breakdown of the triangle formed through the highs and lows from 2022. Oil fell below its 200-week average in 2008, 2014, and 2020, and each time, the decline exceeded 50% before the market gained a foothold.

Interestingly, just like four-plus years ago, this important technical signal from oil preceded the VIX spike to the levels we saw on Monday. However, in 2014, the stock market was still quiet for a long time, and in 2008, the fall in oil was a belated consequence of falling stock valuations.

The FxPro Analyst Team