The markets are starting the new week with a rally. Over the weekend, Yellen optimistically assured that quick approval of the stimulus package would return unemployment to pre-crisis levels as soon as next year. This is very positive news as markets believe that the relief package is just around the corner and they trust forecasts of the Finance minister’s and former Fed’s chair.

The bets on the acceleration of economic recovery are pushing oil prices up. Brent is approaching $60, while WTI has moved above $57. Fresh upside momentum for oil, which has been adding 0.5% since the morning, was provided by a proportional dollar drawdown after Friday’s NFP.

The dollar’s reversal to the downside, while the markets are optimistic, is one of the best combinations for higher oil prices.

Right now, oil is at pre-pandemic levels due to lower supply. In the US, daily production levels have averaged 11m BPD since last May and have been hovering very close to this level for the past three months. Such figures are 15% below production levels a year earlier. This reduction is comparable with the self-imposed caps from OPEC+, where production decreased 10% y/y.

The recent OPEC estimates showed that demand is now also lower by around the same 10%. China has reduced its demand by only 3%, while Europe slumps more than 13% and the US by 11%.

Extensive stimulus in the USA promises to accelerate the demand recovery. This is already partly evident from the inventory data, which shows a decline for 9 out of the last 11 weeks. In other words, the markets are eating into inventories.

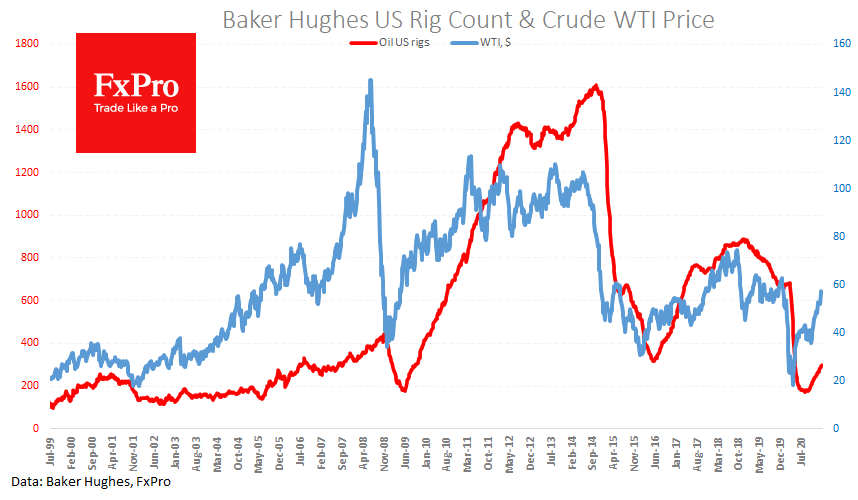

The weekly data showed an increase in the number of rigs in the USA to 392, which could be seen as an impressive 60% jump to last July levels. However, it is correct to realise that this is only 49% of working rigs a year ago. Judging by the stagnant production, the current US drilling activity scale allows the current output to be maintained, but no more than that.

At the same time, there are risks for oil. Russia calls OPEC+ self-restrictions a “sweet gift” for the US. However, it has so far compromised in negotiations by agreeing to very cautious quota increases.

US drilling activity lags behind a recovery in production. However, history suggests that this recovery could be very sustained, creating constraints on price growth. Strictly speaking, the US shale boom had turned the price of oil down first from $100 in 2014, and from $70 four years later. It may not be easy for oil to break away from levels above $60 sustainably. However, with the support of a weak dollar and market euphoria, the upside momentum could well cause the price to touch $70.

The FxPro Analyst Team