Crude oil prices rose on Monday as storms closed in on the Gulf of Mexico, shutting more than half its oil production, and on signs of progress in development of a COVID-19 treatment. Brent crude was up 32 cents, or 0.7%, at $44.67 a barrel by 0753 GMT. U.S. West Texas Intermediate crude rose 31 cents, or 0.7%, to $42.65.

Energy companies shut more than 1 million barrels per day (bpd) of offshore crude oil production in the U.S. Gulf of Mexico because of the twin threat from Hurricane Marco and Tropical Storm Laura. Workers have been evacuated from more than 100 production platforms.

Also supporting prices was a report by the Financial Times that U.S. President Donald Trump is considering fast-tracking an experimental COVID-19 vaccine being developed by AstraZeneca (AZN.L) and Oxford University. On Sunday Trump also hailed FDA authorization of a coronavirus treatment that uses blood plasma from recovered patients, a day after he accused the agency of impeding the rollout of vaccines and therapeutics for political reasons.

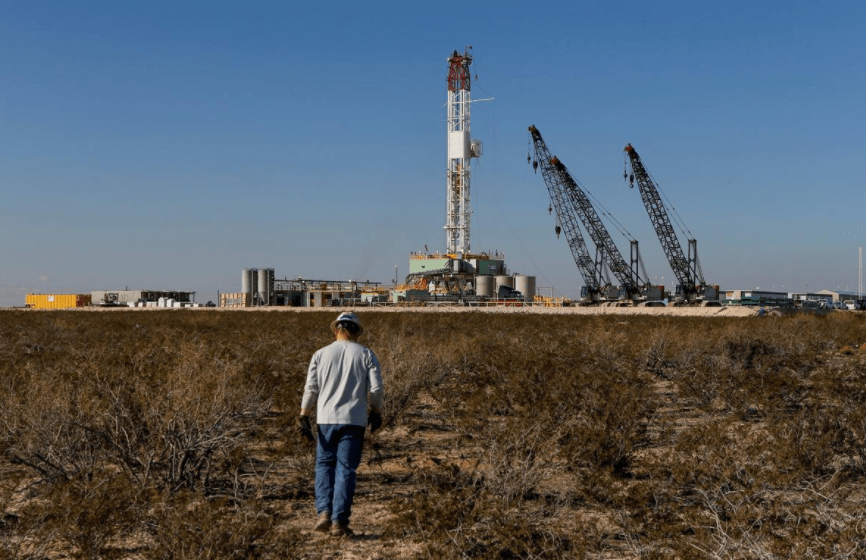

Oil price gains were kept in check, however, by an increase in the U.S. oil and natural rig count for the first time since March, with the addition of the most oil rigs in seven months as shale producers resume drilling.

Oil gains on storm-hit U.S. output and COVID-19 treatment hopes, Reuters, Aug 24