Oil prices have been rising since the start of last week, up more than 12%. The growth comes on the back of positive news on China-US tariff negotiations. The decrease in geopolitical tensions in Russia-Ukraine and India-Pakistan relations in recent days has not had a significant impact on quotations. This may be due to a lack of confidence in progress in these areas or the concentration of market participants on positive news.

Weekly data from the US supports the optimistic approach. Over the past fortnight, the number of active oil drilling rigs has fallen to 474 from 483. This decline is due to oil producers reacting to the decline in oil prices to 4-year lows. This was also evidenced by a slight decline in production to 13.37 million bpd from 13.46 million bpd previously.

Meanwhile, commercial oil inventories have been falling by 2mbpd and 2.7mbpd in the last couple of weeks, which is the opposite of the seasonal trend of rising inventories. As a result, commercial inventory levels are now 4.6% lower than a year earlier.

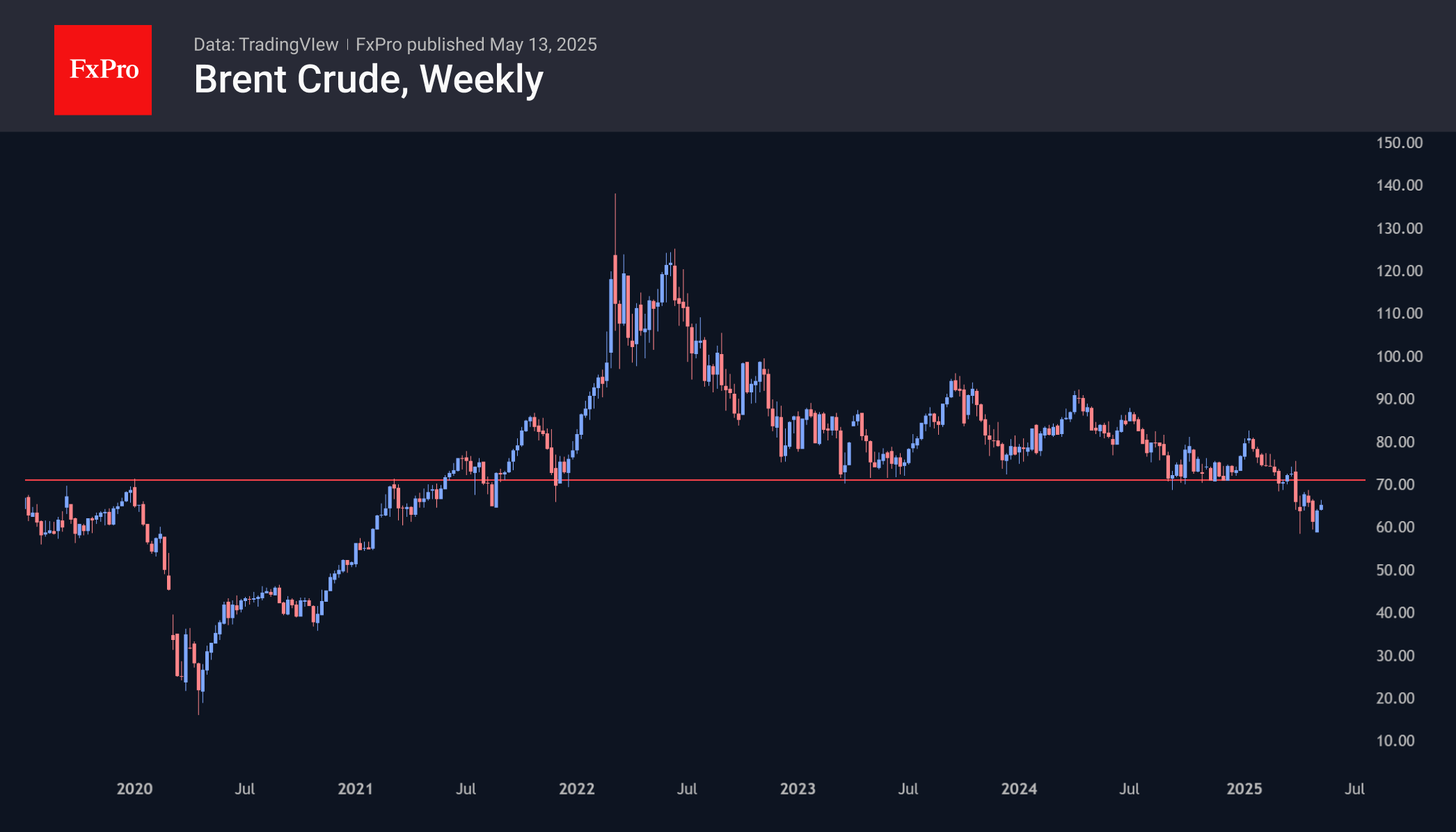

Although daily timeframes show a bullish divergence (new price lows correspond to a higher RSI value), more emphasis is placed on the weekly charts. There is no similar divergence between them, and the price has yet to be tested for the April reversal area.

Only exceeding $67 per barrel of Brent and $64 for WTI will attempt to turn the rebound into growth. The final confirmation will be a strengthening of another $4 to $71 and $68, respectively. In this case, the price will recover above the former support level, which has become resistance. In addition, a recovery in this area would indicate a rise of more than 20% from the May lows, signalling the start of a bull market.

The FxPro Analyst Team