Energy is expected to regain the attention of market speculators next year due to both technical and fundamental factors.

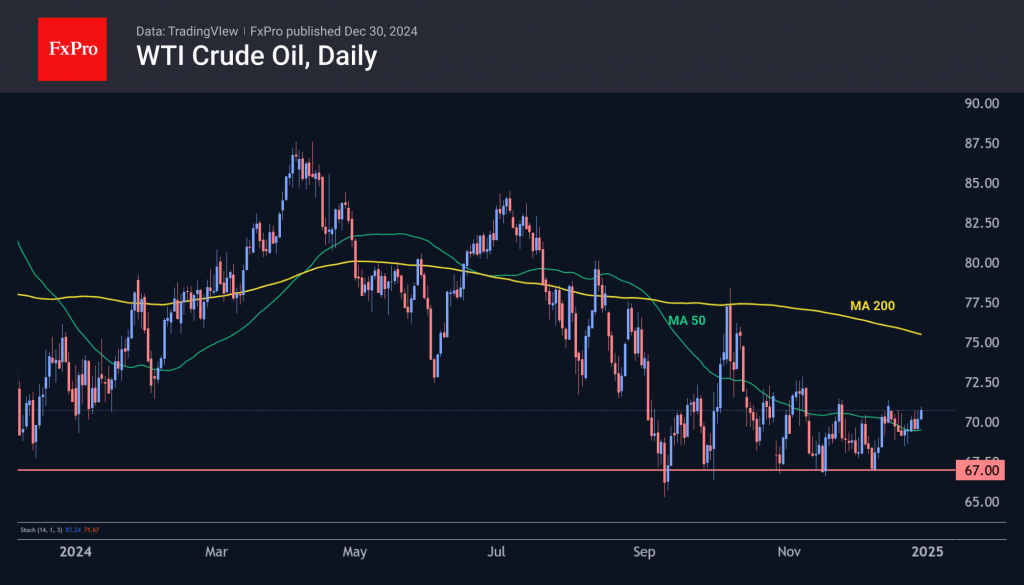

WTI has repeatedly rallied on attempts to break below $67, which has been a turning point on dips since early 2023. A break below the 50- and 200-week moving averages was a bearish signal, but it has not fully materialised. Continued support leads us to consider the bottoming scenario followed by a global reversal.

Technically, oil could rally relatively easily to the $75 level, where it will begin to struggle with its 50-week and 200-day moving averages.

Natural gas, the closest substitute for oil, has rallied almost 90% from its early August lows and is approaching the highs of the past two years thanks to increased demand for US LNG amid Russian energy sanctions. Fears of a cold winter in Europe are also pushing gas higher, which is bullish for oil.

In industry news, we note the five-week decline in US commercial crude oil inventories. Stocks are now 4.5% lower than a year ago and remain near the lower end of the range over the past decade. The picture is complemented by a series of six-week declines in gas inventories, which have moved from the upper end of the range to the middle of the range.

An important factor is the dominance of the Republicans in US politics, among whom the oil industry lobby is strong. The agenda of US energy exports around the world and declining support for alternative energy sources should favour oil.

If our expectations are realised, oil could push off the bottom and start to rise. The easiest part of the rise is seen to be to the $75 level. If the rally continues, the next target will be the $80-86 area. The prospect of an end to the Russia-Ukraine conflict, however elusive, creates moderate downside risks. However, if this or China’s stimulus measures boost global growth, this will have a positive impact on the oil price, taking it to $100 within two years.

The FxPro Analyst Team