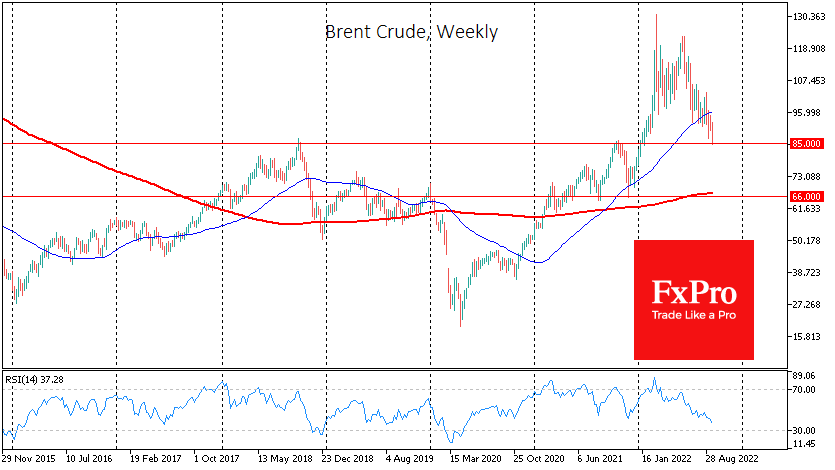

The dollar index surged more than 1% on Friday, putting marked pressure on oil prices, which are losing around 5% since the start of the day. A barrel of WTI is trading below $79, and Brent has fallen back to $85.

The mixture of a slowing global economy, tightening monetary policy and a rising dollar is a rare and highly toxic combination for oil. For many months, the supply fears work as an antidote for some time, and this premium is still very much present in prices.

The oil chart clearly shows that the economy has outweighed politics already in June. However, desperate attempts by OPEC to support the price and the sluggishness of US producers have kept the price from falling sharply. Actual production in the cartel was falling further and further behind the allowable quota level, and, in early September, there was a symbolic reduction in quotas. US companies ramped production to 12.1M BPD, an unimpressive increase from 11.8M at the start of the year.

The fall in the Brent price to $85 rolls it back to the peaks of the previous two cycles – in October 2021 and October 2018. A further steady downward move in oil prices could prove to be an inglorious end to what could have been a new Commodity Supercycle for years to come.

The rhetoric of central bankers and authorities so far makes it hard to doubt their intention to sacrifice markets in favour of price stability. In addition, major geopolitical rivals of the USA, such as Russia, Saudi Arabia, and Iran, with whom there have been a lot of controversies recently, can be “punished” under the surface.

On the technical analysis side, if oil breaks below $85, there is a direct route to $65-68, where the price could be by the end of the year.

The FxPro Analyst Team