Crude Oil has added 3% on Monday after finding support late last week as expectations of a meeting between the US and Saudi leaders did not materialise.

The much-anticipated and much-discussed meeting between Biden and Mohammed bin Salman took place without a joint press conference or formally announced agreements. The Saudis made it clear that the OPEC+ act is good and refused officially to commit to ramping up production despite US interest.

Over the weekend, there were also comments that Saudi Arabia has the potential to increase production to 13m BPD against the current 10m and a peak of 11m in March 2020, but reaching these levels is unsustainable due to underinvestment in the industry.

Weekly rotary rig counts from Baker Hughes point to a further gradual increase in activity in the US to 756 (+4 for the week) total, of which 599 (+2) are oil producers.

Saudi Arabia has ramped up investments in renewable energy, a strategy also followed by major US and UK producers. Because of international sanctions, Russia, Iran, and Venezuela are severely constrained in increasing their production.

OPEC+ seems to do well its homework after past episodes of the “oil wars” of late 2014 and the start of 2020, not wanting to make any sudden moves. Locally, this is positive news for the oil price, which received support on the downside.

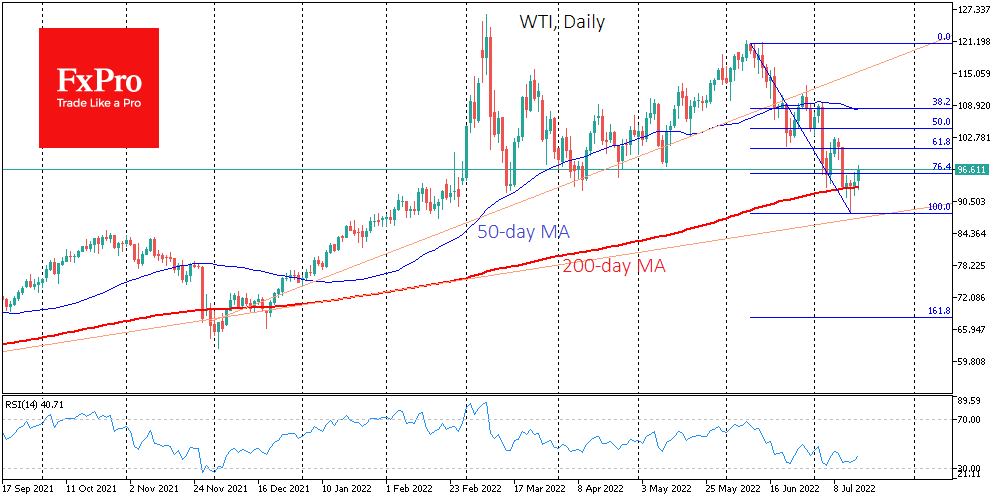

On the technical analysis side, buying support has strengthened on the downside to the 200-day moving average in WTI. Since last Tuesday, intraday downside punctures have intensified buying, and Oil has been closing the day above this significant line that defines the long-term trend.

Brent is now trading above $100, also attempting to move upward from the 200-day moving average.

We may see a serious attempt by the oil bulls to stay within the long-term bullish trend. We would only be able to say that they succeeded in the case of a strong growth above $105 for Brent and $101 for WTI. In that case, a bounce from the latter trend will exceed 61.8% Fibonacci and send Oil into the area above the previous local highs.

However, waning economic activity, with a trend of rising production and interest rates, make the scenario of further declines in Oil the main one to consider.

The FxPro Analyst Team