Oil climbed for a second day on Thursday in light holiday trade as a drawdown in U.S. stockpiles of crude and gasoline raised demand hopes, while hints of an imminent Brexit deal raised investors’ risk appetite. Brent crude futures rose 38 cents, or 0.7%, to $51.58 a barrel by 0530 GMT, while U.S. West Texas Intermediate (WTI) crude futures increased 31 cents, or 0.6%, to $48.43. Both contracts gained more than 2% on Wednesday.

“Lower U.S. inventories of crude and fuels as well as signs of a potential Brexit deal which led to weaker U.S. dollar were good news,” said Hiroyuki Kikukawa, general manager of research at Nissan Securities. “But lingering worries over a new variant of the novel coronavirus capped gains,” he said, adding that oil markets were quiet with investors in holiday mode.

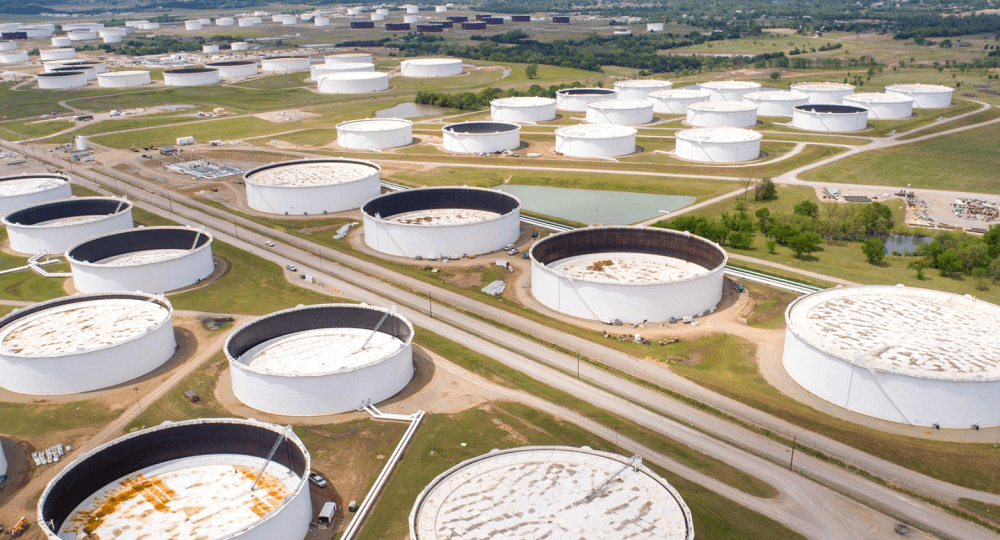

U.S. crude inventories fell by 562,000 barrels in the week to Dec. 18 to 499.5 million barrels, the Energy Information Administration said on Wednesday. Gasoline stocks fell by a surprise 1.1 million barrels to 237.8 million barrels, the EIA said, while distillate stockpiles fell by a more-than-expected 2.3 million barrels to 148.9 million barrels. Oil prices also drew support from news that Britain and the European Union were on the cusp of striking a narrow trade deal on Thursday, swerving away from a chaotic finale to the Brexit split.

The potential deal boosted sterling, which was up 0.2% against the dollar after closing up 0.9%. A softer dollar makes commodities priced in the greenback more affordable for holders of other currencies.

Oil climbs as U.S. inventory draw, Brexit deal hopes boost risk appetite, Reuters, Dec 24