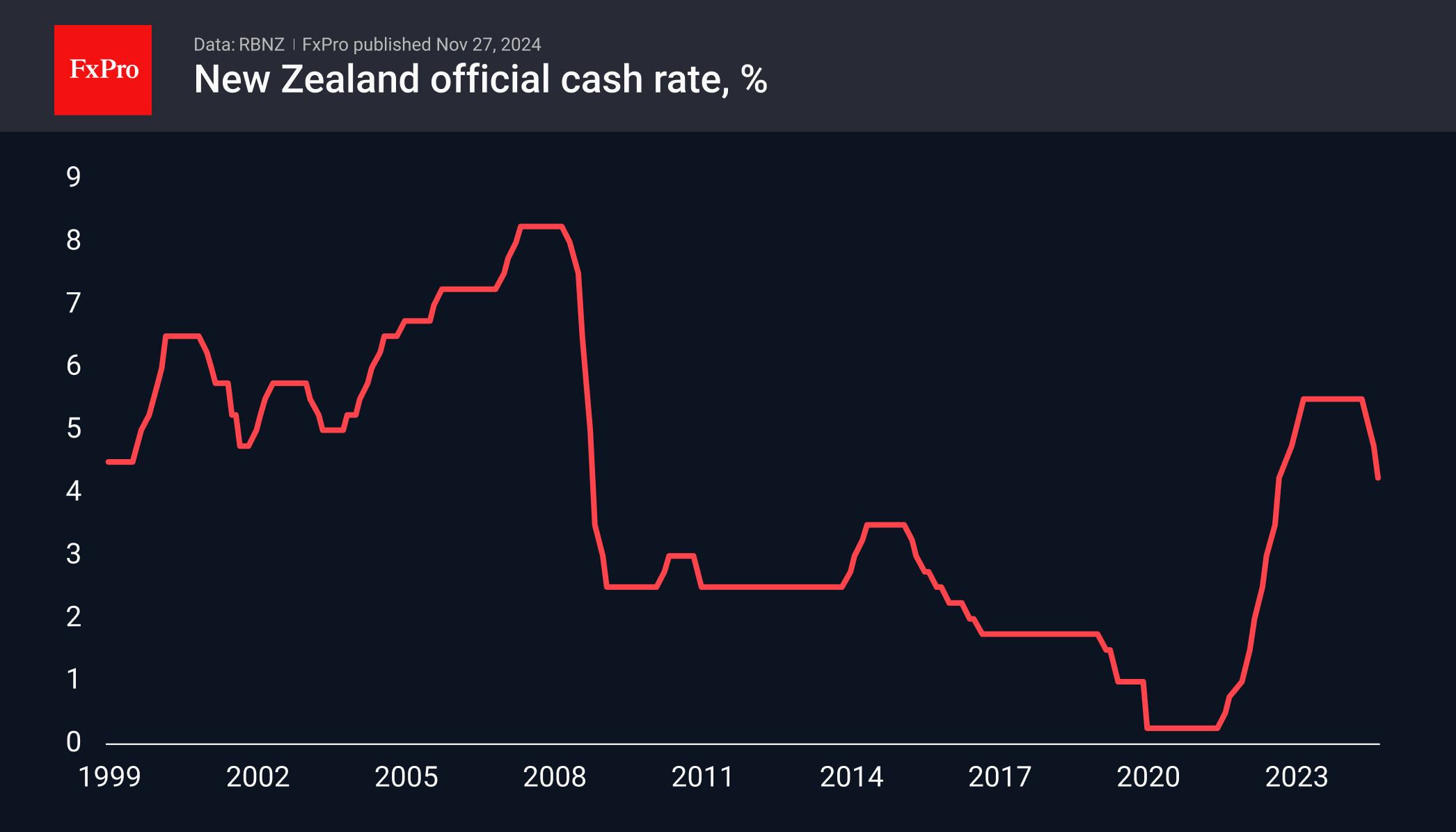

The Reserve Bank of New Zealand (RBNZ) cut its key interest rate by 50 basis points to 4.25%, bringing the total number of cuts in this cycle to 125. The move was in line with average market forecasts, although it represents a higher rate of normalisation than the G10 club of major developed market currencies.

The RBNZ attributed the move to inflation slowing towards the middle of its target range of 1-3% p.a. and inflation expectations stabilising around that level for the next two years. The central bank also indicated its willingness to cut rates next year if there are no inflation surprises.

Fundamentally, the increased pace of rate cuts is negative for the currency, but markets have priced it in since early October. In that time, the NZDUSD has lost over 9%.

This has not only been a result of the Kiwi’s weakness but also the dollar’s strength.

However, the currency market’s reaction has been remarkable. The NZDUSD jumped over 1% in response to the release of the rate decision. So far, this looks like a corrective bounce caused by profit-taking after a strong move. The rally could extend to 0.5940, which is 50 pips above the current price. However, a stronger move to just above 0.6000 cannot be ruled out.

On the other hand, in the minutes of its November meeting released on Tuesday evening, the Fed allowed for a pause in the rate cuts and provided a firmer tone than previously expected.

The tone of monetary policy between the Fed and the RBNZ is diverging in favour of the former. Therefore, it is still difficult to see the NZDUSD’s rise from the lower boundary of the 2-year range as the start of a trend reversal but rather as a temporary bounce unless the fundamental picture changes.

The FxPro Analyst Team