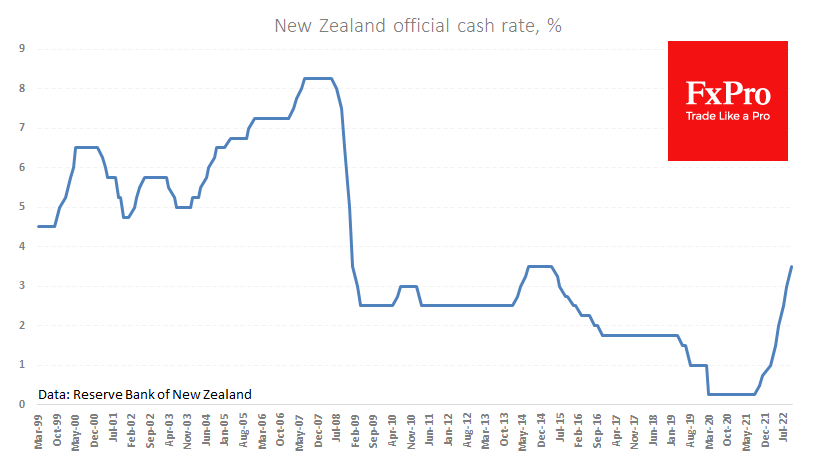

Unlike the RBA yesterday, the Reserve Bank of New Zealand met expectations by raising its key rate by 50 points to 3.5%. Having started raising the rate a year ago, the RBNZ accelerated the move from 25 to 50 points in April, bringing it to the cyclical highs of 2014-15.

The Reserve Bank cites too high core inflation (without food and energy) and labour shortages as reasons for further rate hikes. And here, it is worth remembering that at its peak in 2007/08, New Zealand’s key rate reached 8.25%, and cyclical lows in 2002 and 2003 were 4.75% and 5.00%, respectively. In other words, the New Zealand economy is more suited to high rates than many.

The NZDUSD is gaining 2.6% so far this week and feels quite comfortable since the beginning of the day, in contrast to the pullback in the dollars on Wednesday morning. On the daily charts, the two September lows formed a double bottom. From roughly the same levels, we saw an intensification of buying in the Kiwi in March 2020.

That said, the NZDUSD position remains quite fragile and the initial bounce in the pair could quickly stall if the bears remain the dominant force in the world markets. Cautious traders to confirm a change of trend from bearish to bullish should wait for the pair to strengthen from the current 0.5740 to levels above 0.6000, where the 50-day average and the former support are concentrated besides the beautiful round level.

The FxPro Analyst Team