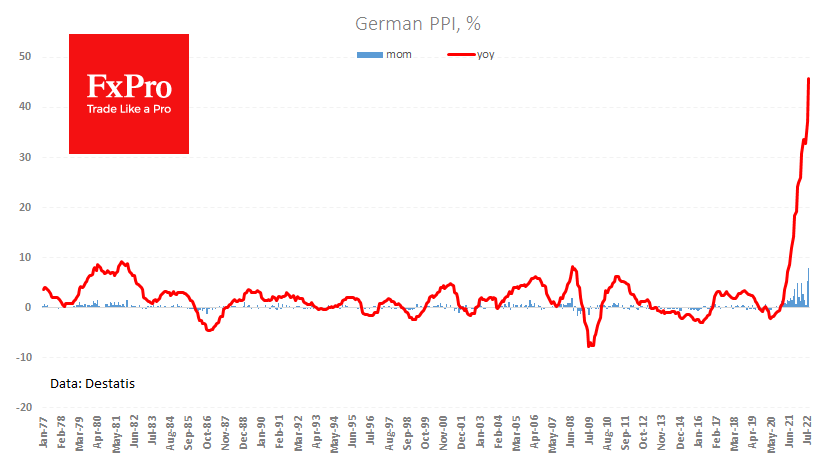

Inflation in Germany continues its hike far beyond the charts. The deceleration of the monthly price growth rate in May and June proved deceptive, followed by a surge of 5.3% for July and 7.9% for August. The annual rate of producer price growth soared to 45.8% from 37.2% a month earlier, contrasting with the expected slowdown to 37.1%.

However, over the last couple of months, the ECB’s stance has drastically changed from trying to “talk up inflation” to unprecedented (for euro-area history) rate hikes of 50 and then 75 points over the last two meetings.

From a currency market perspective, high inflation figures are not weighing on the euro but can support it, as the ECB has moved on from contemplation to data-driven moves.

The euro cannot yet boast of the same reaction to the inflation reports as the dollar did a week earlier. However, the EURUSD closed the previous four sessions with gains, mainly benefiting from the demand during the New York trading session.

The pair appears to have decided to stay close to parity, finding support for the third consecutive month of declines. However, breaking the downtrend now requires more than just technique, but a lower rate hike in the US and a simultaneous acceleration in Europe.

The FxPro Analyst Team