Oil has been in a downward trend since the beginning of June, but in the last two weeks, we have seen excessive efforts by politicians working in favour of oil in the short term, setting up a rebound.

OPEC+ unexpectedly agreed to cut production quotas by 2M BPD. The futures market was not expecting a meaningful change. Moreover, even the verbal comments from cartel representatives last week were tuning in to a cut by 1 million barrels.

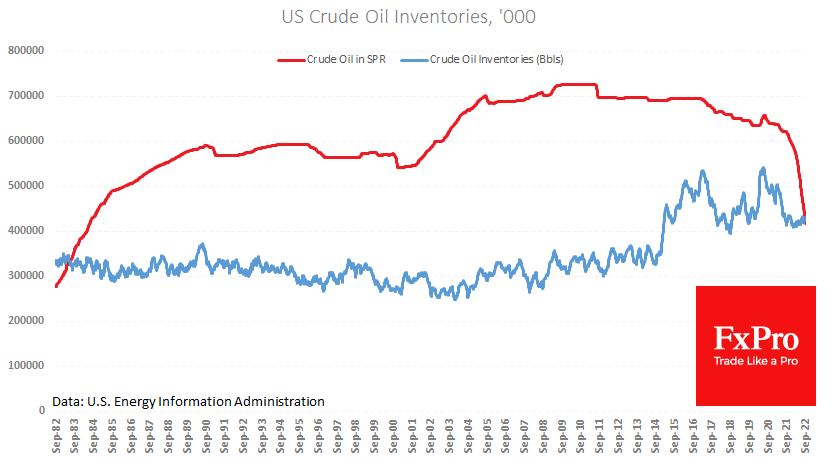

However, in addition to OPEC+, the US also took a bullish stance, announcing that it had no further intention of selling oil from the strategic reserve. Officials are uncomfortable with the strategic reserves falling below commercial reserve levels for the first time in 39 years.

Producers are in no hurry to buck the trend and increase supplies. According to EIA estimates released on Wednesday, US supplies remain at 12M BPD, the average level for the past six months. The situation here is clear: oil sales from reserves have taken away the incentive for producers to ramp up production “yesterday”.

News reports say that the US government is considering ban energy imports (primarily gas) to avoid rising domestic prices by the midterm elections. This could be a new reason for companies domestically to limit oil supplies “today”.

The number of rigs in operation has also stopped rising recently, stabilising at 600. Such dynamics could indicate that oil producers in the USA are unhappy even with current prices.

In addition, the US has persuaded Europe to approve an oil price ceiling, which should lead to a drop in Russian production. According to some estimates, this decline could be as much as 3M BPD. This is a considerable amount for a hyper-sensitive market to the balance of supply and demand, given that the big players are in no hurry to ramp up production.

The price of oil is now being pushed upwards simultaneously by OPEC quota cuts, with the expectation that Russia will cut its supply while the US will focus on filling its market. With these factors, a 15% increase in price in just over a week looks like a transitionary result.

The FxPro Analyst Team