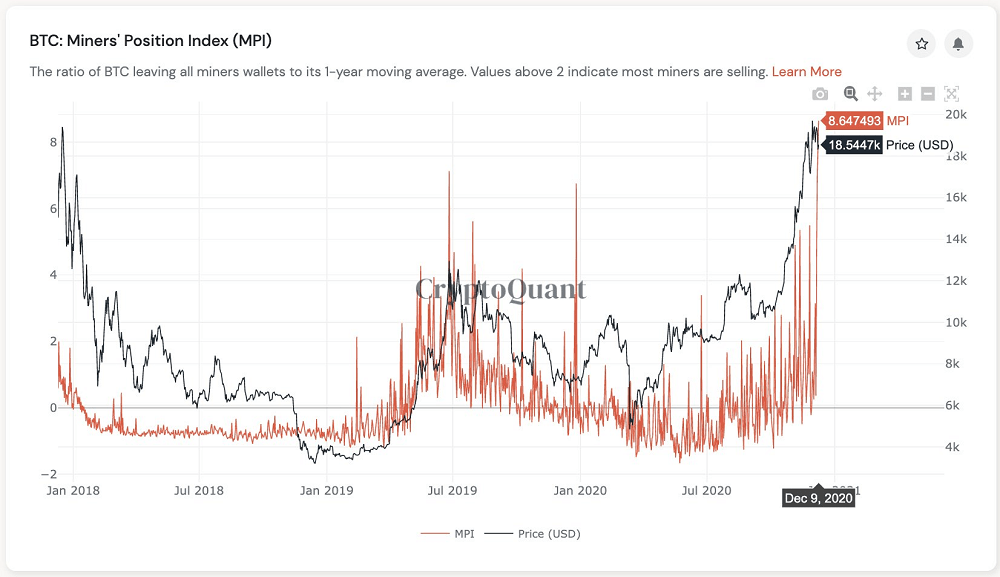

Bitcoin (BTC) miners appear to be selling large amounts of BTC once again. Data from CryptoQuant shows that the BTC Miners’ Position Index — a metric tracking the ratio of BTC leaving miners’ wallets — achieved a three-year high. This trend indicates that miners are likely selling BTC on over-the-counter (OTC) or spot exchanges.

On Dec. 10, two large miner-linked Bitcoin transactions were spotted right as the Miner’s Position Index abruptly spiked to levels unseen since 2017, according to data from CryptoQuant. First, around 800 BTC moved to Binance, which is worth $14.5 million. Second, 11,852 BTC moved to an unknown cold wallet, which is equivalent to $215.9 million.

Miners typically sell Bitcoin through spot or OTC exchanges. When a sell-off occurs on spot exchanges, it could intensify the near-term selling pressure on BTC. The impact on BTC price is not as immediately felt when miners sell on OTC exchanges since they are directly selling to buyers.

In May, Cointelegraph reported that the Grayscale Bitcoin Trust (GBTC) had been accumulating more Bitcoin than mined. In recent months, Grayscale has continued adding to its reserves to pass $10 billion Assets Under Management. If this trend remains intact, it can help offset the selling pressure from miners and whales in the short to medium terms.

In October, Dan Tapiero, the co-founder of 10T Holdings, said Bitcoin could also face a potential supply crisis as a result. Miners could cause a short-term Bitcoin pullback, but BTC repeatedly failed to surpass the $19,600 resistance level. Hence, an argument could be made that the sell-off from miners comes during a period when investors already anticipated a sharp correction. Moreover, on-chain indicators such as the low exchange inflows and Bitcoin exchange reserves at the lowest level since August 2018 could also offset near-term bearishness and prevent BTC from dropping further to $16,000 and possibly lower.

‘Not a good signal’ — Bitcoin miner sell-off risk hits highest in 3 years, CoinTelegraph, Dec 10