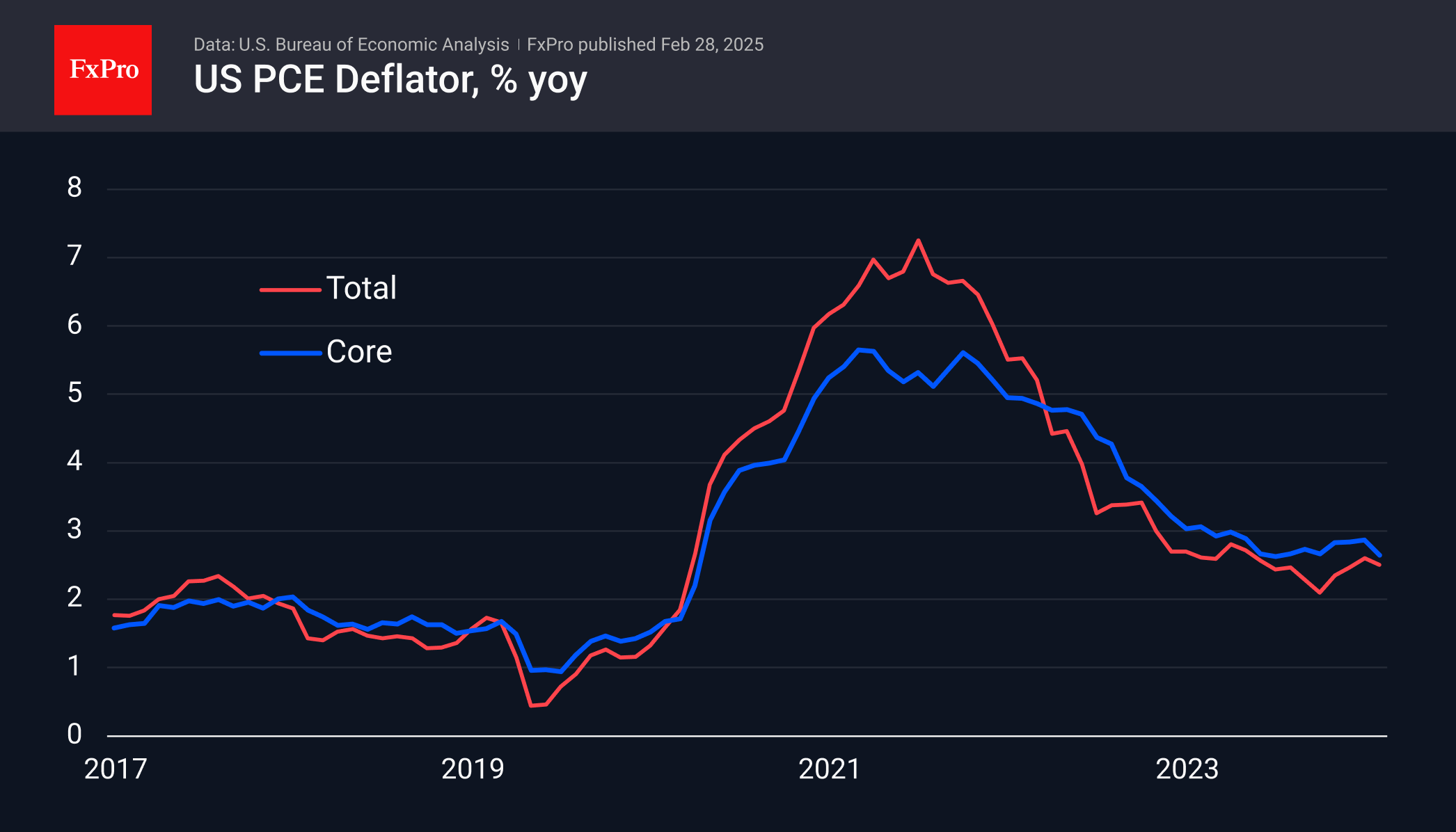

The US personal consumption price index was in line with expectations, which sounds like good news and strengthens the case of the doves at the Fed. The annual rate of increase in the core index fell from 2.9% to 2.6%, the lowest since July. That’s not a big enough change to shake confidence that the Fed will keep the Fed Funds rate on hold in March, but it does increase confidence in an easing later this year. The odds of two or more rate cuts before the end of the year have risen to 80% from less than 50% a week ago.

Equally interesting are developments in consumer income and spending. Personal disposable income rose by 0.9% m/m in January, but spending fell by 0.2%. In the context of previous months’ dynamics, we see this as an attempt to return to normality. The savings rate was 4.6%, a six-month high and in sharp contrast to the 2% rate in the US in mid-2022.

And while this is not good news for the dollar, it is quite positive for equities and cryptocurrencies as they try to recover from the multi-day decline.

The FxPro Analyst Team