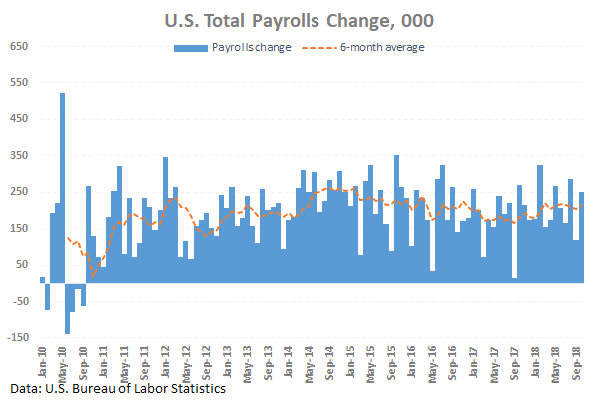

We saw a very strong employment report from the United States, which naturally caused an increase in demand for the Dollar. Although this growth is still very modest (almost an hour USDX added just 0.2%), it is worth paying attention that the American economy with payrolls increase by 250K in October retains the trend growth rate after the failure in September (fact – above average for half a year).

The unemployment rate remained at 3.7% (lows since 1969), although participation rate (the share of the economically active population) returned up to 62.9%.

There is one small point to stay a little bit caution. The average hourly earnings in the U.S. for October rose by 0.2% to 3.1% yoy, which is slightly worse than expected 3.2%. Anyway, this is the highest growth rate since 2009 and a return to pre-crisis rates.

At the moment, the labour market retains its power and remains extremely “tight”. This could be a strong signal for the Fed to continue tightening the policy.

Perhaps these fears were the reason for the return of tensions in the US stock markets, where key indices went down immediately after the publication of a strong employment report.