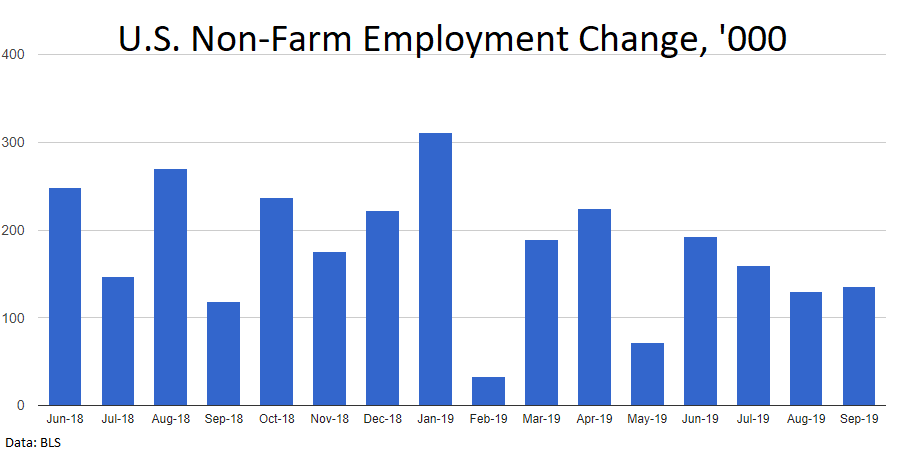

The number of jobs in the United States increased by 136K in September, only slightly worse than the expected 145K. The previous data were revised upwards from 130K to 168K. These are moderately positive economic data that supported the stocks and the dollar in the first minutes after the release.

At the same time, the hourly wages for the last month did not change vs expected 0.3% growth and the year-over-year growth rate slowed from 3.2% to 2.9%. This may be an argument in favour of further Fed rate cuts as potentially ease inflation pressure.