Oil failed on Thursday in another attempt to return to an upward trend. Overall sales wiped out the surge in the first half of the day at the end of the day. This market dynamic is a clear sign that the market is driving the price down and all news from the supply side, from OPEC+ cuts to falling US inventories, form nothing more than a bear market rally.

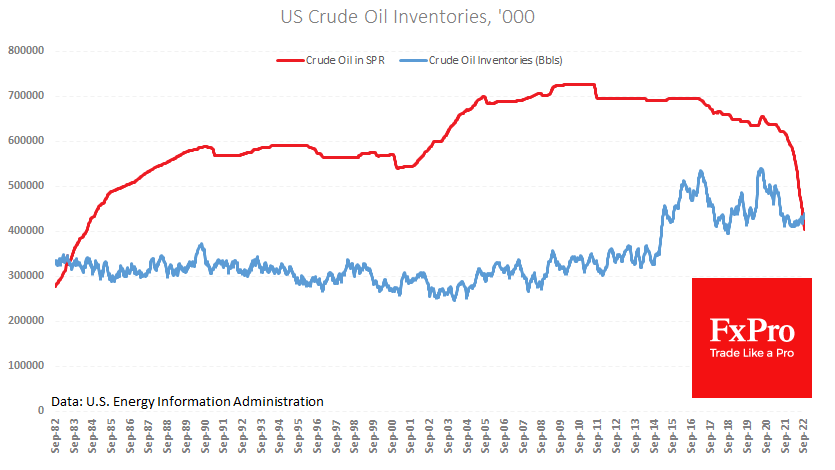

Published data showed a 1.7m barrel drop in commercial stocks last week versus an expected increase of 2.5m. Commercial inventory levels are now 2.5% higher than precisely a year ago, preventing us from saying that America has solved the oil issue.

OPEC+ quota cuts and a very sluggish pace of production recovery in the US are causing Biden’s open displeasure. According to the latest figures, around 12m BPD is now being produced – which is the average of the last six months, i.e., there has been no significant progress here.

It is no coincidence that the stagnation in production coincides with the period of oil sales from reserves because it is not easy to get companies to ramp up production to reduce the final product’s price. That hardly works in a free market.

That is why Biden offered the industry both a stick and a carrot on Wednesday. He criticised oil companies for generous dividends and share buybacks instead of investing in production. However, oil producers, having fallen foul of the ESG agenda in previous years and the difficulty of financing new projects, prefer to return cash to shareholders rather than expand their oil and gas supply further. It’s not just the US; the UK’s biggest lender, Lloyds, said on Thursday it would not support direct financing of oil and gas projects despite the energy crisis in Europe. Right now, fossil fuels are vital, but they generally retain the ‘dirty’ and ‘toxic’ label for investors.

The carrot is a vital price benchmark: the intention to return to filling reserves when prices are below $70 a barrel. In the short term, oil has responded by rising, as the announced prices are close to the market. However, in the medium term, this buying intention will work for supply expansion and can bring prices closer to the stated $70. As we can see, the upside momentum from the latest comments from US officials has been even shorter than the OPEC+ cuts, underlining the bearish nature of the move in the oil market. While the global economy slows and downside risks in America and Europe increase, we are unlikely to see anything more than a bear market rally.

The FxPro Analyst Team