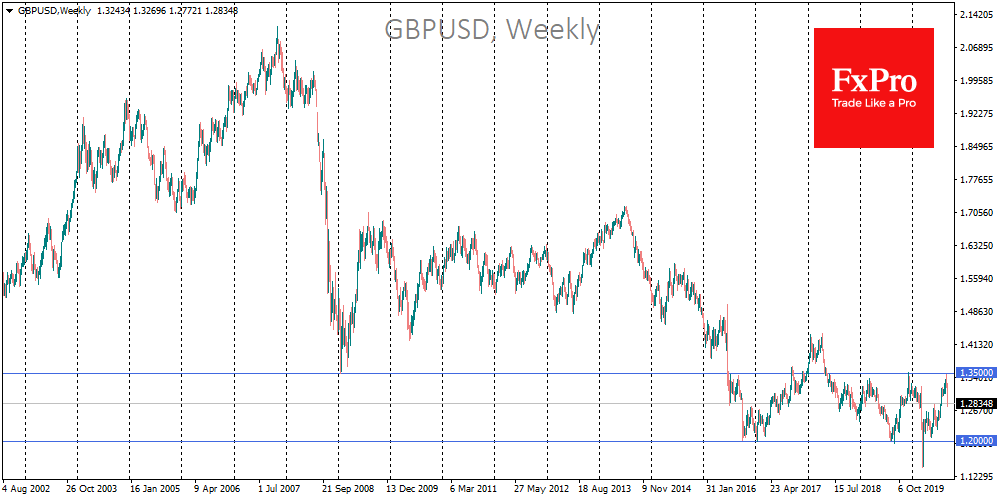

The British pound still being hit hard in September, with severe losses against the dollar and euro. The departure from the area around 1.35 at the beginning of the month due to dollar recovery has been replaced by a stronger wave of pressure due to Brexit.

After a long pause, this was again the main driver for the pound. As a result, GBPUSD lost 5% to 1.2770 on Thursday night, from early September when it rose to 1.3480.

Overall, it is worth noting that the pound has not been able to gain a foothold above 1.3500 in the last two years, as each time there is the pressure of bad news around Brexit, the bulls submit.

It is interesting that after each unsuccessful test of the 1.35 area we saw ever deeper slumps in the pair from 1.27 in August 2018 to 1.14 in March 2020. However, one should bear in mind that earlier this year the pound was pressed not so much by Brexit as by the total risk-off in the markets. Except for this episode, we will see final buyer demand appear near 1.20, where the pair turned upwards at the end of 2016, as well as in August-September 2019 and May 2020.

A clear resistance area has also emerged in recent years in the euro vs the pound. EURGBP is visibly losing momentum after surging above 0.9200. Yesterday was the fifth time over the last four years that the pair took this threshold.

The pound is more resistant against the euro, especially when it comes to the influence of disagreements on Brexit, as an unorganised exit from the EU threatens to cause problems for all parties. This makes traders pay attention to the euro, which may sink against the dollar because of British problems. But the single currency can also suffer from hypoxia at current altitudes against sterling.

Besides, the British economy is recovering at a relatively good pace. Monthly GDP estimates published this morning showed a jump of 6.6% in July after 8.7% a month earlier.

This causes us to watch out for further moves in EURGBP. With the help of bad news, the pair may shoot higher for a while, but the chances are high that a prolonged correction will follow.

While GBPUSD may not be heavily hindered up to levels around 1.2000 by the end of September, the EURGBP risks losing its growth momentum and turning downwards in the coming days, leaving the area at 0.8500-0.8650 before the end of the year.

The FxPro Analyst Team