Nikola shares surged on Thursday, one day after the company said its production timeline and factory plans remain on track amid widespread investor anxiety regarding the company’s business as well as its planned deal with General Motors. The stock soared by as much as 31% earlier in the day, recently trading up by about 16% just before 1 p.m. But the jump does little to dent the stock’s recent weakness; shares have tumbled 37% in the last month.

Short-selling firm Hindenburg Research accused the company of fraud in a scathing report released last month. The findings reportedly kicked off investigations by the Securities and Exchange Commission as well as the Department of Justice and ultimately led to founder and former executive chairman Trevor Milton’s exit from the company.

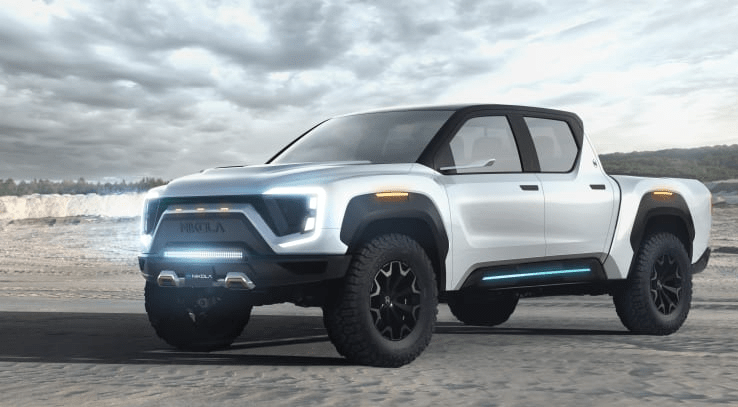

Hindenburg’s claims sparked doubt among investors that Nikola’s previously announced deal with GM would come to fruition. The deal has not yet been finalized, despite initial targets to have it done before this past Wednesday. But the two companies remain in discussion, according to Nikola CEO Mark Russell. The partnership would give the Detroit automaker an 11% stake in the company for supplying Nikola battery and fuel cell technologies as well as producing Nikola’s Badger pickup.

Nikola shares surge as much as 31% after management confirms production targets, CNBC, Oct 1