While the calendar’s second half of the year started last Friday, it will probably not begin in the markets until the upcoming US jobs data is released this Friday. It is worth sorting out where the US currency currently stands on the forex market.

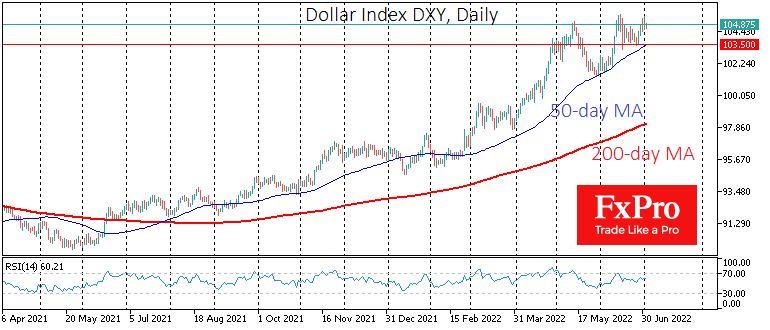

The Dollar Index has climbed to a 20-year high in the middle and at the end of June after a 12-month upward move. That’s an impressive age for a currency market, but it still takes more than old age to change a direction.

To assess the chances of a trend reversal in the USD, investors and traders should now pay closer attention to the labour market data and the Fed’s reaction. Weak employment growth data could confirm the current level of the Dollar Index as unbreakable. However, we shall still have to wait for data assessments from the Fed to confirm this.

However, another option is more likely. High inflation could stimulate the recovery of the labour market as more and more people will look for earning opportunities. This would pave the way for another 75-point key rate hike by the Fed in the second half of July, allowing interest rates to reach neutral levels in the next 6-8 months. That is much faster than developed country competitors will do, forming the conditions for further strengthening the Dollar.

Another attempt to take the 105 level by storm will likely be more successful. A corrective pullback in May from these heights was followed by a much shallower retreat in June, reflecting a strengthening of the bulls’ position. As has been the case over the last year, significant technical support is the 50-day moving average.

Should the week’s outcome follow the first bearish scenario, investors and traders should keep an eye on the 103.5 area. A sharp pullback below that would be a significant reversal signal. However, the index will likely touch new highs before the reversal.

The FxPro Analyst Team