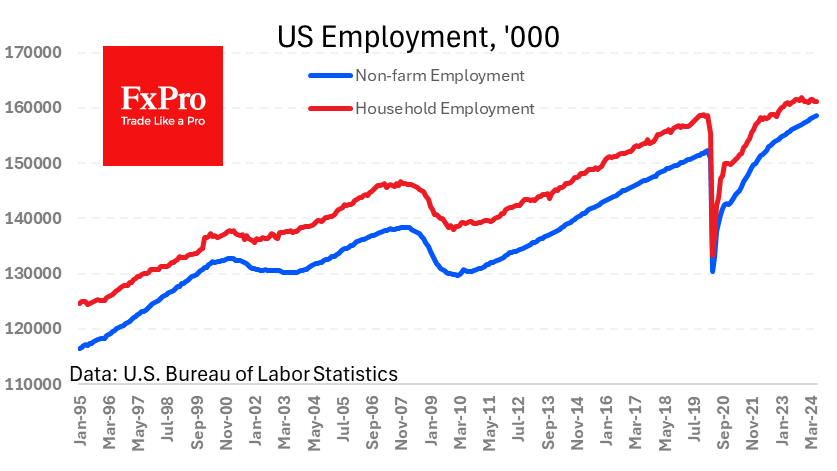

The US economy created 206k new jobs in June, slightly better than average expectations. However, May’s gain was downgraded from 272k to 206k, and April’s from 165k to 108k. The combined 123k downgrade of the previous two months’ estimates suggests a noticeably tighter labour market picture than previously imagined.

Unemployment reached 4.1% – the highest since November 2021 – up smoothly from 3.4% in April last year. Earlier, signs of a reversal were seen in the weekly benefit claims data, which also saw a multi-month upward trend.

It is only a matter of a month or two before we see a drop in US employment, which will be an important catalyst for kicking off the rate cut cycle.

At the same time, the pace of wage growth (4.1% y/y) does not suggest elevated wage growth. Still, high inflation expectations are unlikely to allow the Fed to act quickly and decisively enough to prevent a recession in the second half of the year.

The current report is moderately negative for the USD and potentially reverses its appreciation trend since the beginning of the year. At the same time, it is short-term positive news for the stock market, as it could lead to a reassessment of expectations. But we are wary of such growth based on negativity. Sooner or later (and this moment is impossible to guess), the negativity from a slowing or shrinking economy outweighs the optimism from interest rate expectations.

The FxPro Analyst Team