Oil came under pressure on Wednesday, losing more than 2% on reports by Bloomberg that OPEC+ plans to raise quotas again at its next meeting. Last month, the cartel removed all additional self-imposed restrictions that major producers such as Saudi Arabia, Russia, and Kazakhstan had taken on.

This new move is an open demonstration of the fight for market share, rather than an attempt to support prices. First and foremost, it is a fight against the US, which is actively promoting its energy through policy, imposing sanctions on oil-producing countries and including oil and gas purchases in trade deals.

If the reduction is indeed confirmed, it promises to be an impressive factor of pressure on quotations, overturning the upward price trend of the previous couple of weeks.

Earlier, oil was supported by a reduction in commercial stocks in the US and the return of risk appetite to stock markets, thanks to signals of a September rate cut.

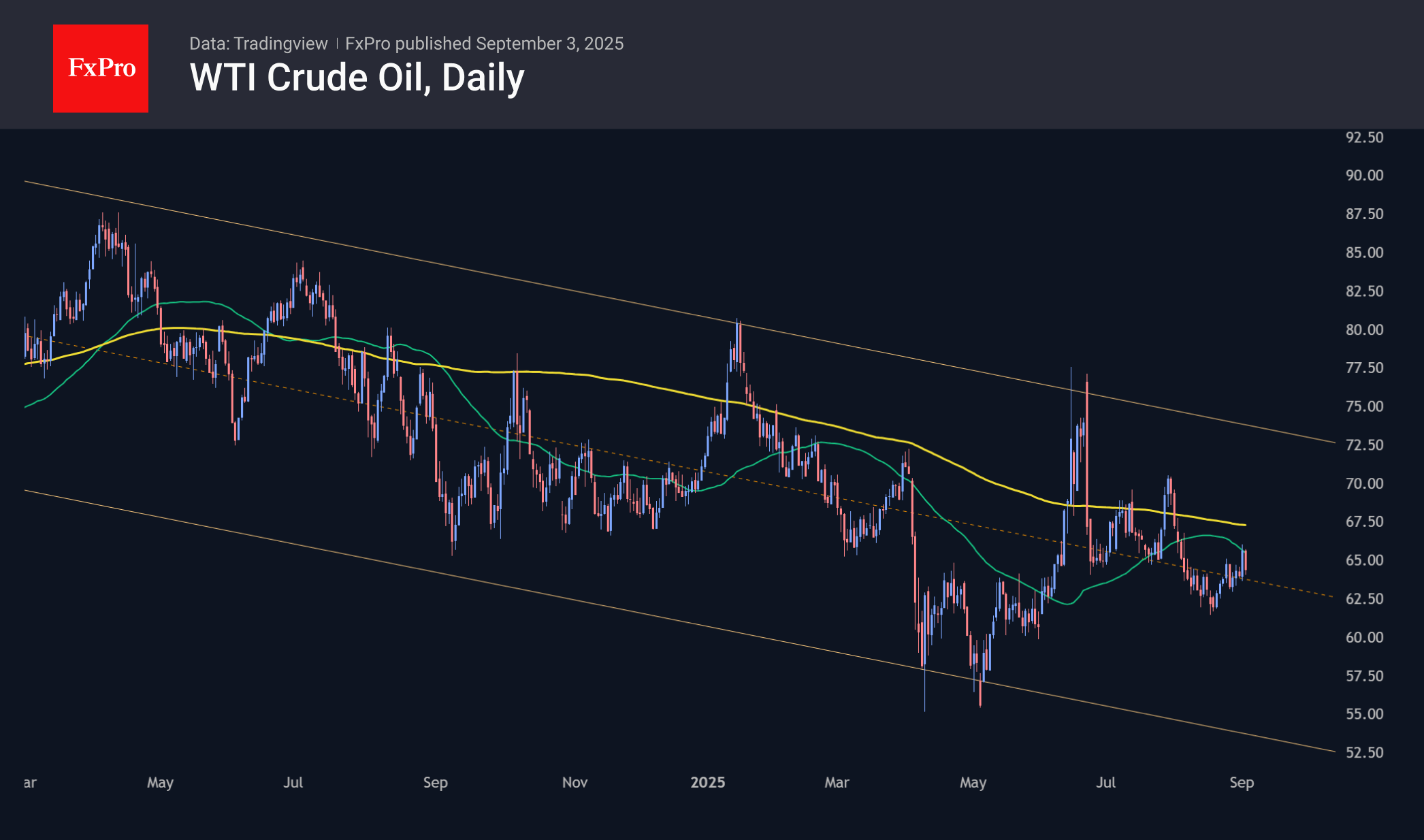

With its reversal on Wednesday, oil confirmed the strength of resistance in the form of the 200-day moving average and the previous consolidation area. Although oil has exceeded this curve several times over the past year, it still acts as a trend resistance line.

Three attempts by Saudi Arabia and its frenemies to switch from supporting prices to fighting for market share in 2008, 2014, and 2020 drove the price below $30, devaluing it by more than three-quarters. But in both cases, the increase in production coincided with an economic and market downturn. This is not happening now, which supports prices and allows OPEC+ to increase quotas.

However, for many countries, increasing quotas is much easier than increasing production. Countries such as Russia and Iran cannot simply sell oil and increase production due to sales restrictions and equipment limitations. This will keep prices from falling, keeping them within a downward range rather than turning into a collapse like we saw in late 2014 and early 2020.

On balance, this supports our previous forecast for WTI falling to $55 by the end of September and to $50 by the end of the year, barring any economic shocks. It could also fall to the $30 range if there are risks of a looming global recession.

The FxPro Analyst Team