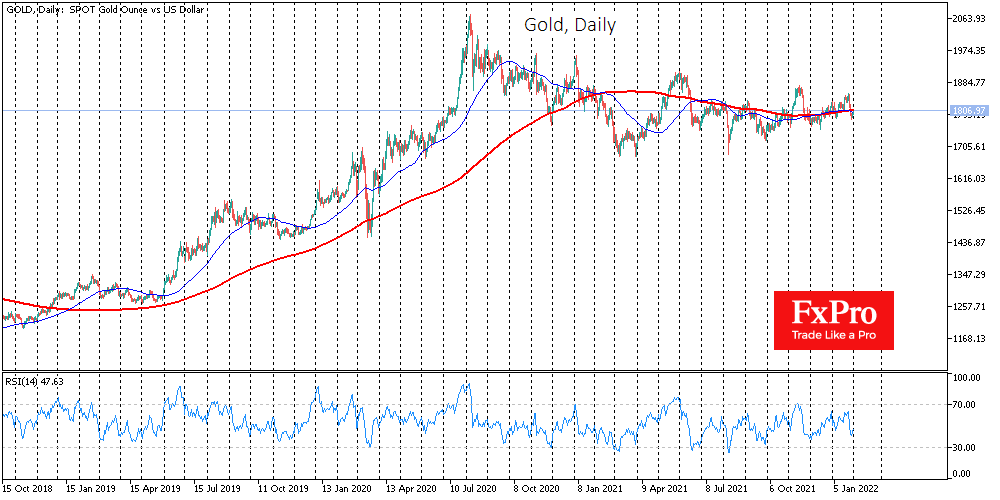

Gold is attempting to return to the $1800 area on Tuesday. The bulls do not want the price fixing below this round level, as they want to avoid the markets starting a wider liquidation of long positions in the metal.

The latest FOMC comments have seen the price drop more than $70, from around $1850 to $1780. It looks like the latest level is a new stepping stone, which has withstood the bears’ attack since the second half of December.

Prior to that, $1680 in March 2021, $1725 in August, $1760 in November and December were the impassable support levels. Buyers have activated on the declines towards $1780 since the last days of last year, and the return to that level late last week was also accompanied by increased buying.

The harsh tone of the US monetary authorities and the pressure in equities has almost wholly nullified the gains in gold from the levels of early December. However, a second consecutive day of buying after a downturn can now be seen. Gold bulls are neatly buying out the decline.

At the same time, it is too early to talk about signs of a rally, and it is better to wait for local technical signals. One of those signals might be a fixation above $1805, through which the 200-day moving average passes.

Even more reliable is to wait for the 50-day (now at $1801) to return above the 200-day, which will give a “golden cross” signal.

Among the related markets, silver is worth keeping an eye on. A bearish trend is still prevailing as the price has reversed three times since August after testing the 20-day average. However, global support near $22 has protected silver this time, effectively playing its role since September 2020.

The FxPro Analyst Team