Discussions around a new $2.2 trillion relief package in the US kept markets afloat on Thursday and are helping to build positive momentum at Asian bourses on Friday morning. Previously, the deadlock in negotiations between Democrats and Republicans was an important pressure factor on stock prices and returned demand for the dollar, which has risen 3.2% since early September against the basket of major currencies.

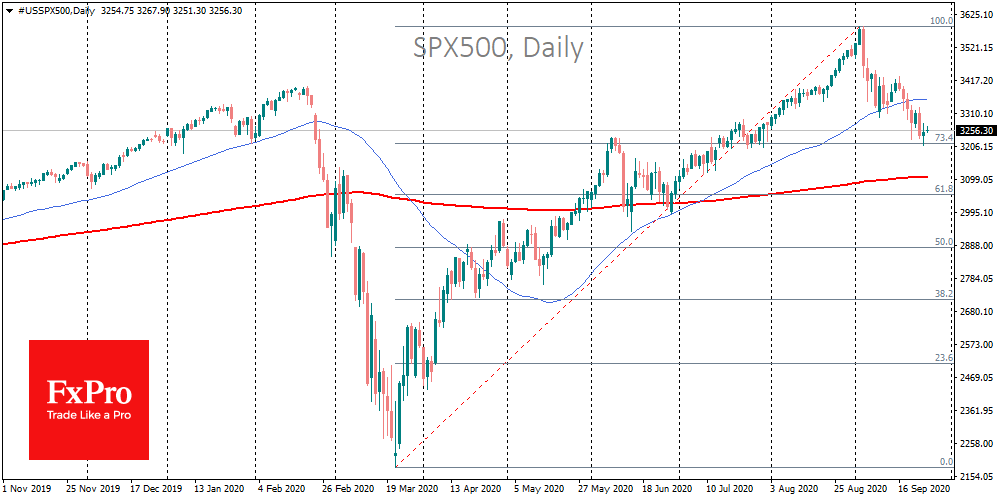

The steady fall in key US indices, as well as the increase of the dollar earlier this month, reversed the trends that prevailed in markets from March to the end of August. On the tech analysis side, we recently received a signal that the dollar is likely to continue its growth and that the stock market is expected to decline.

However, a renewed hope for support packages from the US government could prevail over any technical picture or alter its interpretation.

Recently, they have proven to be net sellers, capturing profits from previous growth and paying attention to the fading recovery.

The main burden of securities purchases in recent weeks has been placed on the shoulders of retail investors, which very often occurs near the market’s peak. This risks being even more intense amid an alarming weak recovery in the US labour market.

Claims for unemployment benefits were again disappointing, with more than 12.5 million people receiving benefits. Without the Federal Supplementary Benefit Scheme, this is leading to a drop in income. Households will have to consume the safety cushion that was formed during the generous government payments in previous months.

But progress in the discussion of relief packages could bring professional managers and funds back to the list of stock buyers.

Some of this money seems to have supported the rally in the markets. The new support packages, if as generous as they were earlier this year, could breathe new life into the stock markets, as some speculators will try to overtake the wave of stock purchases before the actual interest in them from individuals.

Simply put, further news about the promotion of the support package in the US could reverse the downward correction in the stock market, putting it back on the path of growth and thus causing pressure on the dollar.

The FxPro Analyst Team