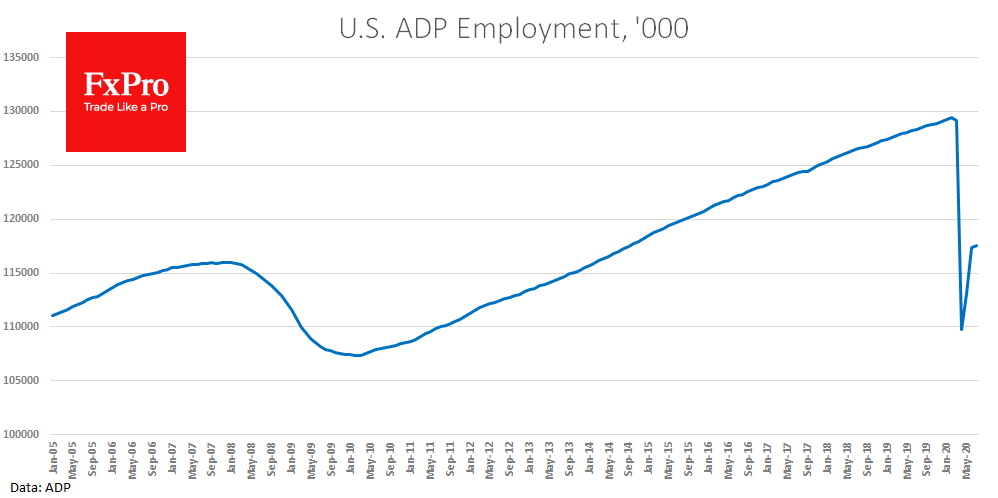

Monthly data from ADP showed an uptick in employment in July by 0.167M, compared to the expected 1.2M. In the previous two months, this figure recorded a rise of 4.3M and 3.3M after the collapse of 19.4M in April. The sharp slowdown in recovery was due to the second, more substantial, wave of COVID-19 growth in the US last month. Total private-sector employment was 117.5M, down 11.9M from the peak in February.

The most significant economic blow seems to have come from the medium-sized business sector. ADP reports that companies with 50 to 500 employees laid off 25K workers in total, while small and large businesses were recovering employment (+63K and +129K, respectively).

The ADP data makes us wait with caution for the release of the official report on the US labor market on Friday, where markets expect to see employment growth of 1.5M. Weak data may make new easing from the Fed more relevant, further harming the dollar.

The FxPro Analyst Team