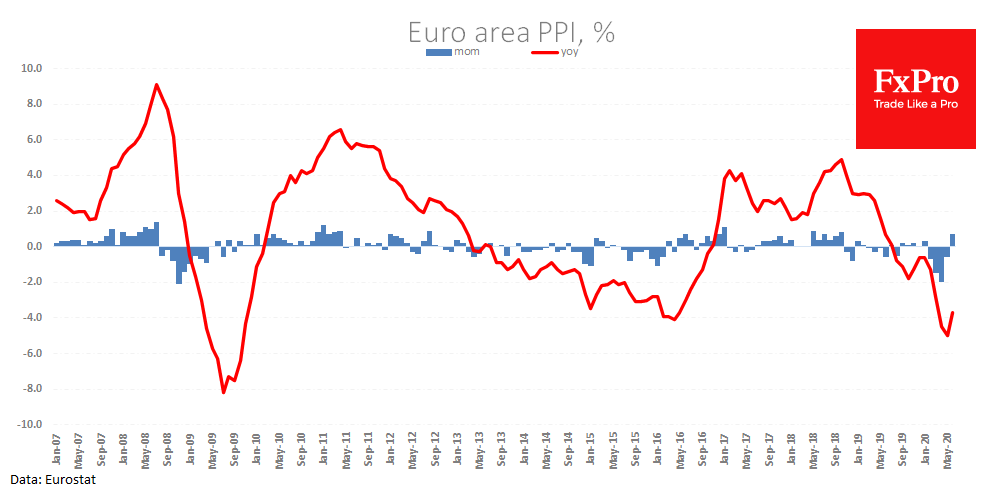

We are getting more and more global data on the acceleration of inflation. Today, the euro area PPI reported a growth of 0.7% in June, vs 0.6% expected. The annual rate reversed from the bottom, rising to -3.7% y / y against -5.0% a month earlier.

Producer prices are often an early indicator of consumer inflation, as companies shift some of the increased costs onto consumers. CPI in the euro area has been accelerating for two months now, and we can see more to come. This has not been the case since the GFC, when prices were falling from August 2008 to July 2009.

We have repeatedly observed rapid recovery in prices in many countries these days. During a crisis, consumers, not companies, receive the most support from the government. This is more pro-inflationary than bailing out banks and bankrupt corporations.

It also means that central banks may need to be much more vigilant about inflation and scale back their stimulus much earlier than they did after the start of the global financial crisis.

The FxPro Analyst Team