A bipartisan group of senators introduced legislation to punish Russia for interfering in U.S. elections, and for exerting “malign influence” in Syria and aggression in Ukraine, setting up a potential clash with President Donald Trump. The bill includes sanctions on Russian banks, new sovereign debt, liquefied natural gas investments, political figures and oligarchs, and its sponsors include Lindsey Graham, a South Carolina Republican who’s usually a Trump ally. Similar legislation last year, in response to alleged provocations by Russia, never received a vote.

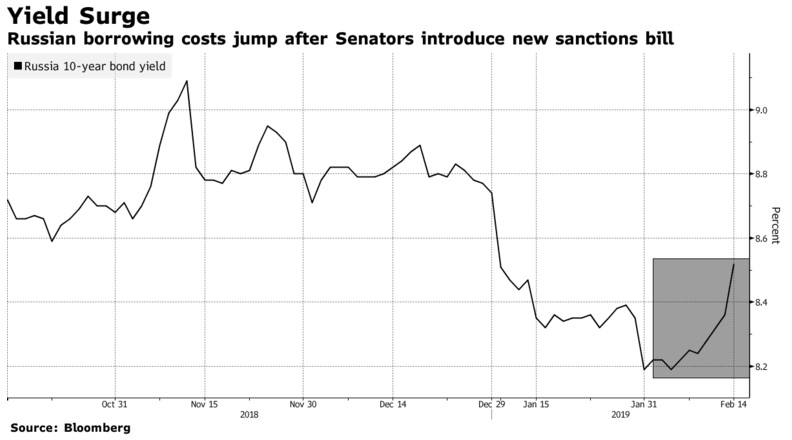

Under the measure proposed Wednesday, Trump would be blocked from pulling out of the North Atlantic Treaty Organization without clearance from the Senate. It also calls for a report on Russian President Vladimir Putin’s net worth and assets. Russia’s currency slumped in August and the central bank was forced to raise interest rates when similar measures looked like they were gaining traction in Washington. The ruble extended its slide on Thursday to the weakest in a month, and yields on local-currency bonds jumped the most since September.

The sanctions proposals “aren’t pleasant, but Russia has taken measures to respond to them,” Finance Minister Anton Siluanov told reporters in Moscow on Thursday. Liquidity and state support will be provided to state banks if they are hit by restrictions so that depositors aren’t affected, he said.

Senators Publish New Russia Sanctions Bill Targeting Debt, Bloomberg, Feb 15