Stock indices

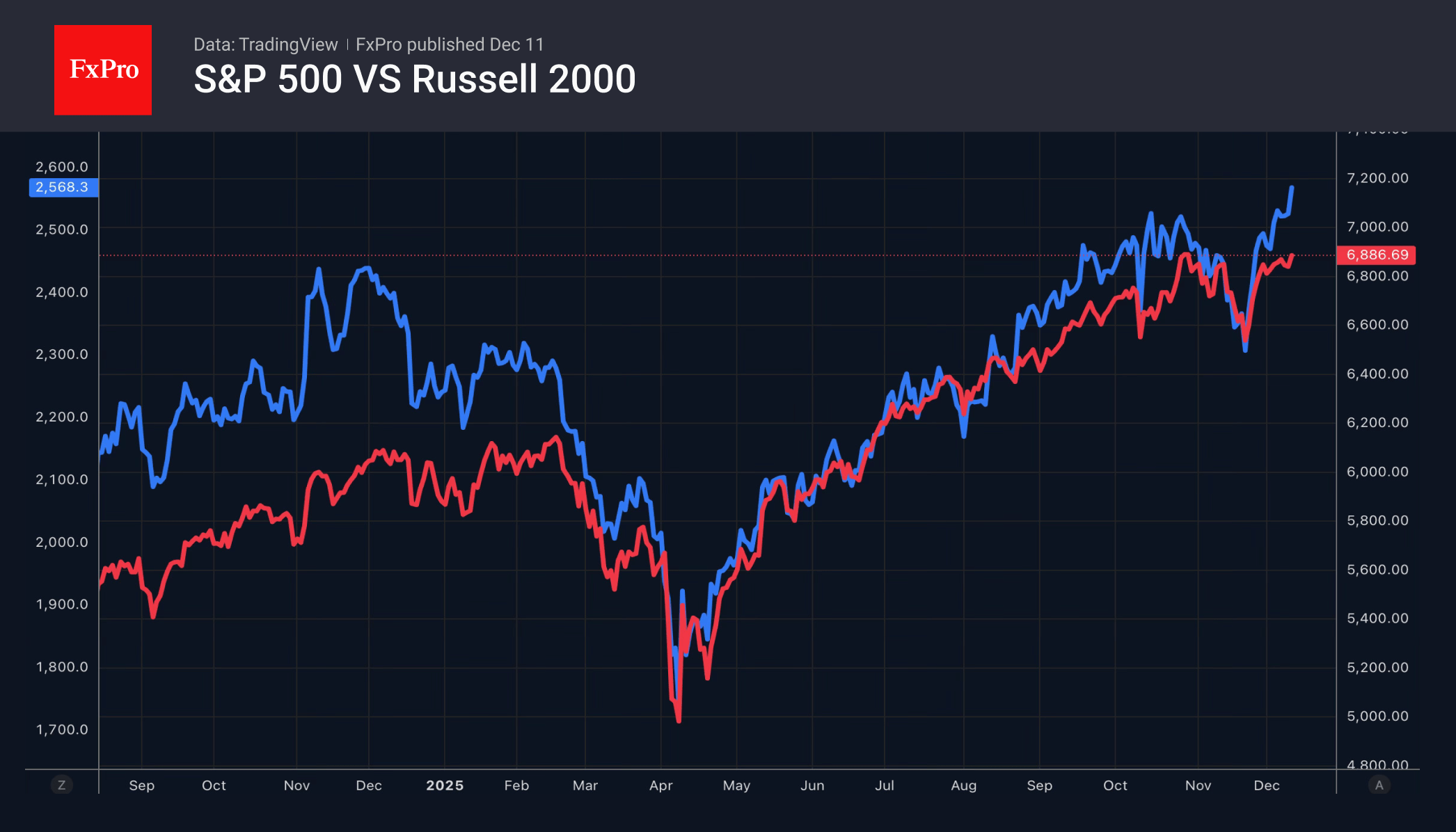

The Fed managed to please the American stock market by easing its policy and forecasting an increase in GDP from 1.8% to 2.3%, as well as a slowdown in inflation from 3% to 2.5% in 2026, while also discussing the positive impact of AI on productivity. As a result, the S&P500 experienced its most dramatic reaction to an FOMC meeting since March, and the Russell 2000 set a new record.

A strong economy and inflation heading towards the 2% target present a prime opportunity for stocks. Along with increased productivity, this indicates that S&P500 companies may see growth in corporate earnings. Historical episodes in which the Fed cut rates and markets were near their peaks have shown higher levels 12 months later in every case.

However, expectations for the next rate cut have now shifted to April, removing the indexes safety buffer. There may be renewed talk of a tech giant bubble, as evidenced by Oracle’s shares plunging sharply after the company reported disappointing earnings.

According to Yardeni Research, investors should diversify away from the “Magnificent Seven” and seek opportunities in other issuers, as artificial intelligence is transforming nearly every company into a technology firm.

What is ahead

The key events of the third week of December will be the release of US labour market data for October and November, as well as central bank meetings. The ECB, the Bank of England and the Bank of Japan will have their say. Investors will also pay attention to European business activity data for December.

Jerome Powell says that FOMC officials have similar views on the US economy but differ in their assessment of its risks. Hawks are concerned about high inflation, while doves are worried about the cooling labour market. If employment figures disappoint, derivatives will shift expectations of monetary policy easing from April to March, and possibly even January. This will weaken the dollar. On the other hand, a pleasant surprise from non-farm payrolls will allow the USD to recoup some of its losses.

While no changes are expected from the ECB, the Bank of England is 90% likely to cut its repo rate to 3.75%. However, the negative is already priced into the pound, and in the event of hawkish comments, the pound could strengthen. The fate of the yen will depend on the outlook for the Bank of Japan’s leadership. Few doubt that the overnight rate will be raised, but what next?

The FxPro Analyst Team