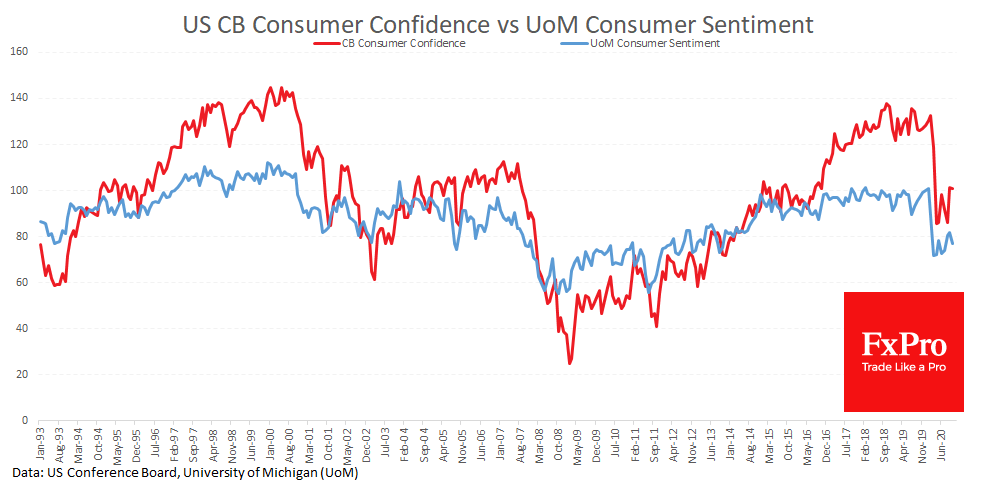

For the second time this year, the Coronavirus impact is increasingly evident in macroeconomic reports. The University of Michigan consumer sentiment index has interrupted the recovery, falling from 81.8 to 77, according to a preliminary November estimate. The reversal came from 2014 levels, clearly indicating that consumers are still wary of spending.

It is clear to see that the recovery of the index has not kept pace with the growth of stock markets, retail sales and the housing market, where we have already seen peaks being exceeded. Weak consumer sentiment raises the issue of the need to further stimulate the economy, which has been delayed by politicians.

An additional worrying factor is an increase in long-term inflation expectations. 5-years inflation expectations have bottomed out in February and are gradually growing. Financial markets have seen a rise in the yields of 10 and 30-year bonds, which also reflects higher inflationary expectations.

The FxPro Analyst Team