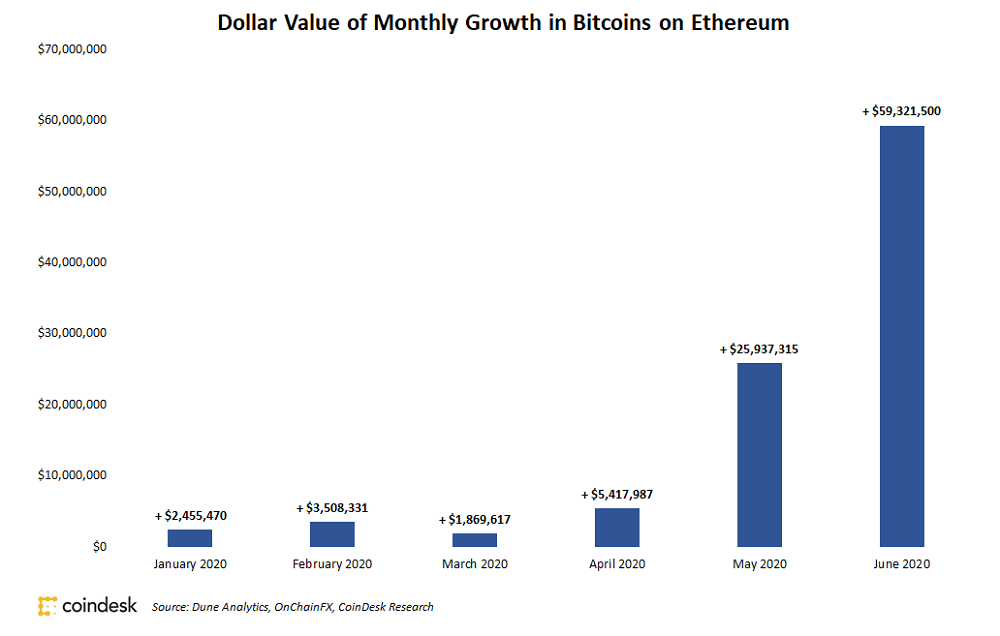

Nearly $60 million worth of bitcoins moved to Ethereum during June, according to data estimates from Dune Analytics. Wrapped Bitcoin, the oldest tokenized bitcoin protocol on Ethereum, is responsible for roughly 75% of that growth after moving more than 4,800 BTC to Ethereum last month.

Demand has increased for using bitcoin in a variety of decentralized financial services as Ethereum continues to be the most popular off-chain destination for bitcoins. More specifically, yield farming and MakerDAO adding tokenized bitcoin as collateral are likely strong catalysts, said Medio Demarco, former associate at Deutsche Bank and co-founder of cryptocurrency research firm Delphi Digital.

The increasing popularity of tokenized bitcoin is also no surprise to Ben Chan, CTO at BitGo, the cryptocurrency payments processor that spearheaded Wrapped Bitcoin. “The purpose of WBTC is to bring bitcoin to the world of decentralized finance,” Chan said. “Yield opportunities for lending and supplying WBTC” in Ethereum-based applications are driving recent growth, he added. Currently $132 million worth of bitcoin is on Ethereum, at the time of publication, or roughly 0.08% of the leading cryptocurrency’s market capitalization, according to OnChainFX.

Is the growing demand to use bitcoin on Ethereum a positive signal for the leading cryptocurrency? According to Demarco, the trend has a “synergistic” effect for both blockchains.

Cars, a cocktail and a celebrity: South Koreans succumb to Tesla fever, CoinDesk, Jul 8