The energy market may have passed an inflexion point yesterday. The more than 20% jump in prices in Europe on Tuesday to $1,500 per 1,000 cubic meters triggered an avalanche of margin calls during the trading on Wednesday. At one point, it topped $1,950 at the beginning of the day before plummeting to below $1,700 within 5 minutes. By the day’s end, the price slid back below $1,500.

Such market dynamics is clear evidence of margin-calls on short positions in futures, executed soon after the opening of the European market, which was executed in the market, without regard to the price.

It mirrors the story of a year and a half ago when US oil prices went negative on the forced closure of long positions in the futures. It is particularly ironic that once again, it was the energy market.

The triggering of margin calls alone is not enough to turn the market around. It only happens due to a shift in the balance of supply and demand, actual or perceived. Russian President Putin was on the bears’ side, promising to increase gas supplies in all directions, including via Ukraine.

For its part, Russia has pointed out that Europe and China have embarked too abruptly on the energy transition. Particularly, China has previously refused to buy coal from Australia (purchases have resumed in recent days) and has preferred to replace it with gas and oil, which has increased competition for gas from Russia. Being one step ahead, Europe has cut its gas production unnecessarily drastically, according to the Russian leader, failing to fully compensate with energy from alternative sources. This was compounded by a rainy summer and a windless September, one-off factors that fuelled the market.

On top of this, there has been increasing evidence that companies in Europe are scaling back their activity because of energy shortages, which is already working on the side of reduced demand.

Gas prices above $700 could remain in Europe for the next few months, although they look inflated in the longer term. They will likely continue their comeback “on the ground” in the coming days. Experts predict that it will no longer be possible to bring stocks back to comfortable levels this season, leaving the risk of under-supply in play as it is now, keeping prices elevated, near $700.

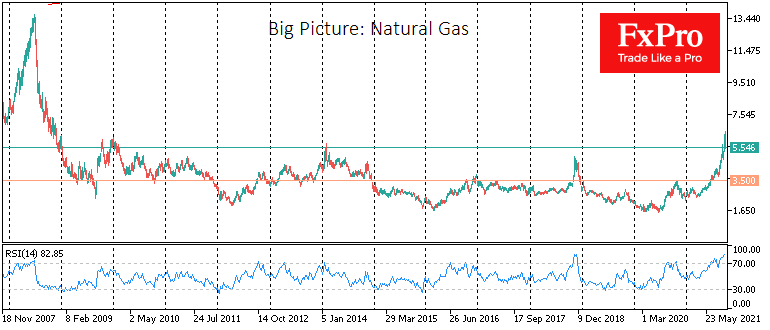

US exchange gas prices were renewing 13-year highs yesterday at the start of trading above $6.5 per 1mn BTU (other units here), 170% above the area lows at the start of the year. The beginning of price stabilisation could take prices into the $3.5 area, where key trend reversals and acceleration have occurred since 2009.

The FxPro Analyst Team