Since the second half of last month, US indices have been struggling to grow. Closing on a strong note at the end of the half-year could trigger a severe correction or even be the first step towards a prolonged decline.

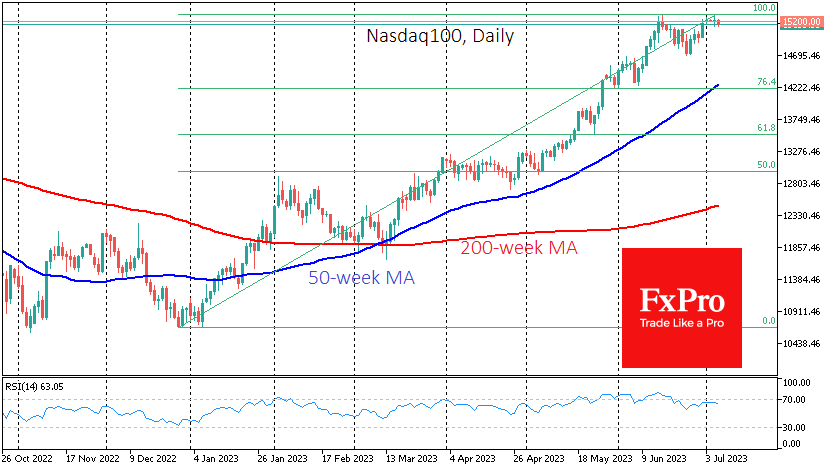

The US Nasdaq 100 index ended the half year with the strongest gain in its history, up almost 40%. The index paused or exhausted its momentum near the 15200 level, which also served as a turning point for the bears in January and March-April last year. This level was also a significant resistance line from July to August 2021.

A complete correction of the year-to-date rally in the Nasdaq100 can go as far as 13500 (61.8% of the rally), but a lesser pullback to 14200 (76.4%) is theoretically possible. Markets need a trigger for such a move, and the Fed’s hawkish tone is not seen as an appropriate reason to sell stocks.

On a weekly timeframe, the index has been in the over-bought territory on the RSI for the past month and a half. For traders and investors, the risk of a full-blown correction increases as soon as the buoyant growth falters. The signal that a correction has begun in the markets would be a sharp drop in the RSI to below 70 from the current 73. A gradual cooling is unlikely to be seen as such a signal.

Perhaps only news of economic contraction or weak quarterly earnings could trigger it. If the recession is severe enough and the Fed does not reverse course, the Nasdaq100 can return to its long-term 50 or even 200-week averages, now at 12500 and 12200, respectively.

However, a bearish reversal needs confirmation, which could be another scramble this week and next.

The FxPro Analyst Team