US inflation data promises to directly impact Fed policy, to which the Nasdaq100 is the most sensitive among key indices. The heavy reliance of the index on inflation and a set of significant key levels makes us watch the Nasdaq100 closely today and in the week with double attention.

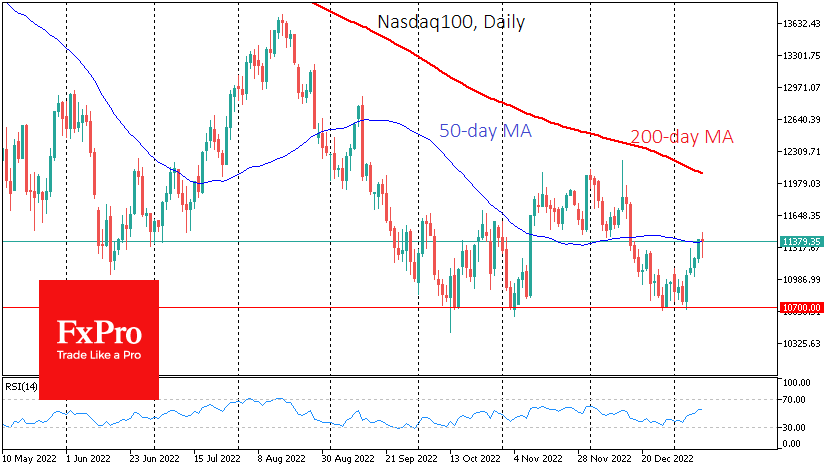

After managing to turn to the upside at the end of last week, the Nasdaq100 index has added an impressive 3.3% since the beginning of the week, rising to 11,400. The latest increase brought the market to another attempt to reverse the downtrend. The inflation data coming out on Thursday, which has become the primary economic market mover in recent months, is set up so that we may see the outcome of this battle in the coming hours.

The Nasdaq100 received clear support on dips to the 10,700-area last October and December. From about the same levels, the rally in September 2020 started. Thus, the bulls defended basic levels, which is not enough to start a new rally.

Despite the “double bottom”, the Nasdaq100 maintained a sequence of declining highs, and the sellers brutally crushed the attempt of the market to rewrite the local highs in December.

The moving averages are also pointing to the importance of momentum. On the daily timeframes, the Nasdaq100 is trying to return above the 50-day moving average. By the way, the same moving average has been supporting the Dow Jones for a month. Successful consolidation of the Nasdaq100 above its 50 SMA would probably take the next target of the 200 SMA, which is now close to 12000, coinciding with the reversal area of December and generally represents a more critical trendline.

On the weekly charts, the 11500 area, where the 200-week average passes, looks like an important trend signal level. In 2018 and 2020, approaching this area attracted long-term buyers. From October through December 2022, declines below that curve were also quickly redeemed, but buyers ran out of steam in the year’s final weeks. This week looks more encouraging, but this may change in a matter of hours.

The FxPro Analyst Team