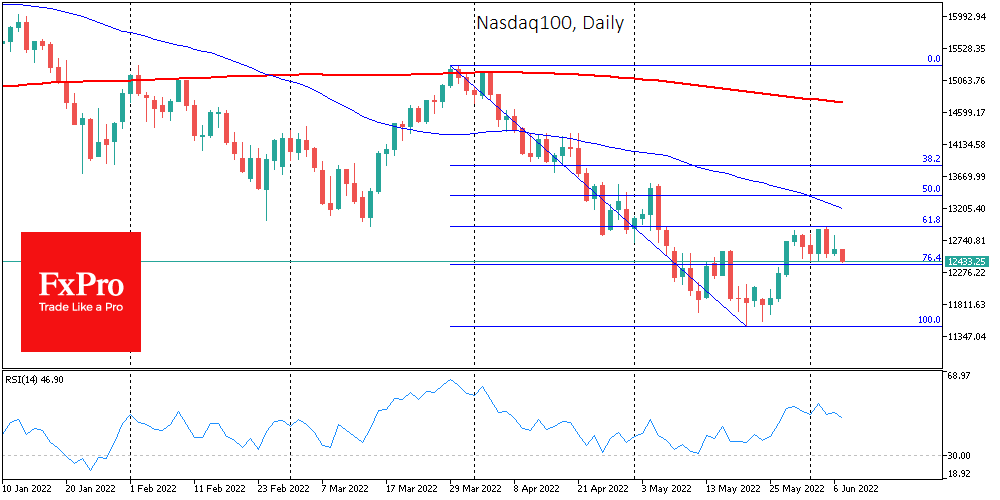

Late last week, the Nasdaq100 failed to break above the 61.8% mark of the decline from March to May amplitude. The sharp deterioration of last Friday, the failed attempt to get back up on Monday and the renewal of the local lows by the index futures at the beginning of the day on Tuesday is a possible prologue to a further downward spiral.

As with the first wave of declines from December to March, the fall was over 20% before we saw a corrective bounce. At the end of March, the stock’s recovery depleted on the approach to the 200-day moving average.

Last week the bears took over the initiative as the Nasdaq100 was approaching 13000, close to which was the significant support area of early 2021 and the 61.8% level of the global advance from the lows of March 2020 to levels of late 2021. Thus, the market has not reached a new level of recovery.

The market sentiment right now is more inclined to think that the rise in the last week of May was just a rebound in a falling market. If so, then the next logical target for the bears will be the 11500 area – the previous local lows.

If that too falls under the pressure of worsening macroeconomic data, it is worth preparing for a pullback to 11000, a significant round level near the 200-week moving average. The latter line has been solid support in the declines of the Nasdaq100 since 2010 though now and from 1989 to 1995 when the dot-com rally ripped the index off its long-term trend.

While the Nasdaq100 at one time looked almost as detached from its long-term trend as it did at the turn of the century, it would still be too premature to adjust for a commensurate loss to 85% of the peak as it did 20 years ago.

The FxPro Analyst Team