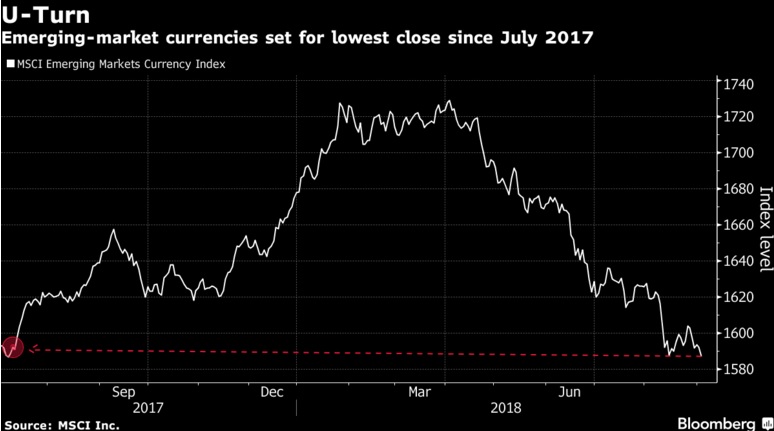

Pledges from Turkey and Argentina to shore up the lira and peso failed to bring comfort to most emerging markets, putting a gauge of developing-nation currencies on course for its lowest level in more than a year. The dollar advanced a fourth day amid rising tension between China and the U.S. over trade.

MSCI Inc.’s index of currencies dropped for the fifth time in six days, led by the rupiah and rand. Turkish bonds rallied, while the lira retreated, after Monday’s vow by the central bank to reshape its monetary policy-stance. Argentina’s dollar bonds also advanced following President Mauricio Macri’s announcement of emergency measures to stem the crisis. Emerging-market stocks were poised to end a four-day losing run, led by tech shares, while the extra yield investors demand to hold develop-nation bonds instead of Treasuries fell.

“The measures announced by Argentina and Turkey are probably not enough to lead to a significant improvement in their fundamentals,” said Tsutomu Soma, general manager for fixed-income trading at SBI Securities Co. in Tokyo. “Contagion risks to other emerging markets are growing especially as the Fed tightens, leading to sell-offs of some assets from weaker economies.” Turkey and Argentina have been at the epicenter of emerging-market tumult this year as investors assess their idiosyncratic issues as well as global headwinds including tighter central bank policy and the China-U.S. trade dispute. Coupled with a rising dollar and U.S. rates, the pressure on assets across developing nations this year has been relentless.

Moves From Turkey and Argentina Fail To Reassure Nervous Investors, Bloomberg, Sep 04