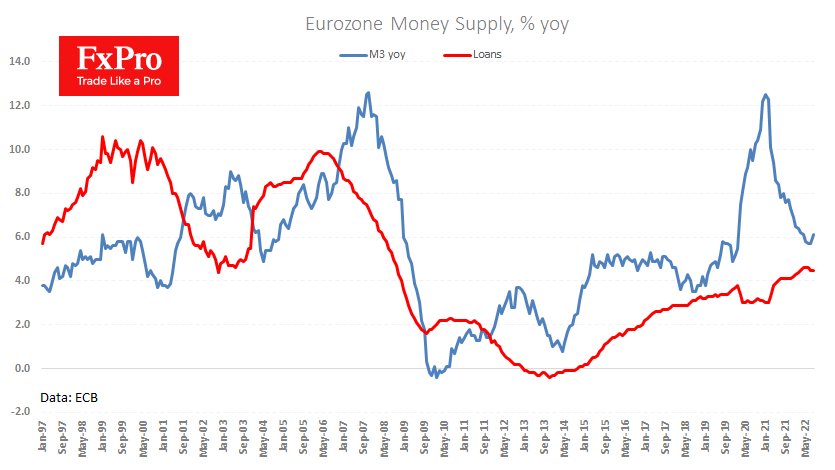

The trend of relentless sliding economic indicators in the eurozone paused today with the publication of money supply and private lending indicators. Monetary aggregate M3 showed a 6.1% y/y increase in August compared to 5.7% a month earlier and the expected 5.4%. This was the first year-over-over rate acceleration since last October.

An acceleration in the rate of growth of this indicator indicates an increase in money in circulation, which is an additional pro-inflationary factor. The gain here points to strengthening the inflationary spiral beyond rising energy prices.

We also draw attention to the robust performance of private credit, which has shown a growth rate near 4.5% YoY in the previous six months. The simplified conclusion is that there is more money in the Eurozone financial system. If the ECB does not or fails to buy these processes, this will add to the fundamental pressure on the euro in the medium term.

The FxPro Analyst Team