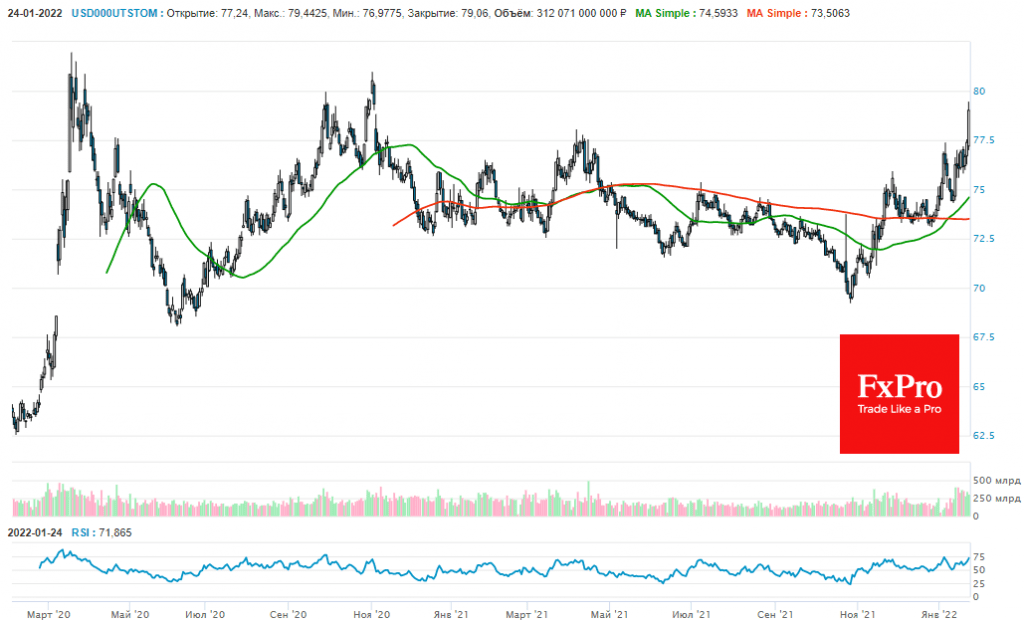

The ruble remains under pressure on Monday after four weeks of decline. The USDRUB is above 77.7 and approaching the area of last year’s highs.

Technically, the situation looks like a moment of truth for the ruble. An easing of geopolitical tensions has the potential to turn it around on the way to 78, as it did several times last year. And we can see that Russian politicians the previous week were ready for more constructive negotiations and compromises.

However, it has not yet come to de-escalation, and pressure on the ruble persists. Reports that the US and the UK are set to expel diplomats from Kyiv have created a new local momentum of pressure on the ruble.

Fixing the dollar above 78 rubles today could be the starting point for a jump of USD/RUB to 80 and EUR/RUB to 90 this week.

At the same time, we believe that the overheating is close to the peak. Further chances for stabilising the situation at the current level or even compromising are higher than stricter rhetoric. In this case, the ruble would have the opportunity for another turn down from 78-80 for the dollar and 88-90 for the euro.

In a partial geopolitical agreement, the Russian currency would remain tied to global risk demand, which is contracting in January. Therefore, even with a favourable geopolitical scenario, one should not expect the ruble to quickly return to levels of the start of the year.

The FxPro Analyst Team