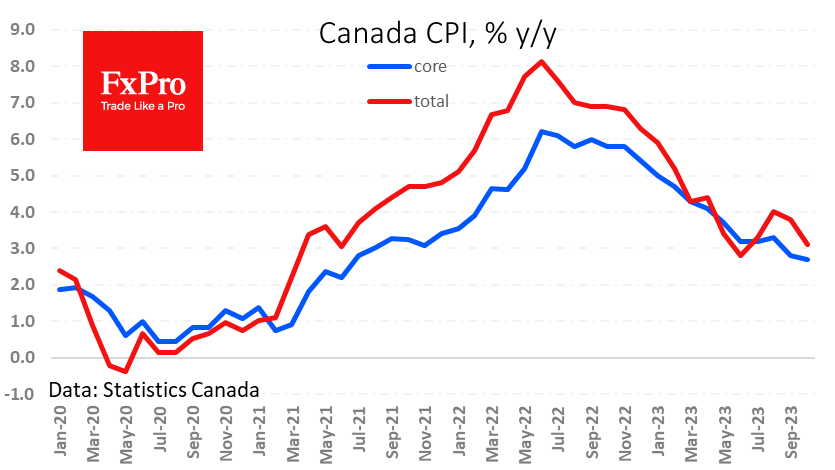

Overall inflation slowed from 3.8% to 3.1% y/y in October versus an expected 3.2%. On the other hand, core inflation came in above expectations, ticking up 0.3% y/y in October, albeit lowering the annual rate of increase from 2.8% to 2.7%.

Inflation risks stalling near 3% in the coming months as Canadian data undergoes a high base effect, with a 0.7% jump in prices last October, followed by a 0.1% rise in November and a 0.6% decline in December. Prices need a repeat of the dip late last year to push annual inflation below 3%.

Today’s statistics support those waiting for an extended pause on Canada’s key rate, providing no food in favour of a hike or an earlier reversal.

The FxPro Analyst Team