Gold has rallied to a record this year as the coronavirus pandemic savaged growth, with gains supported by massive inflows into bullion-backed ETFs. Bulls are fearful that the waves of stimulus to fight the slowdown may debase paper currencies and ignite inflation. They also point to simmering geopolitical tensions, rising government debt burdens, and lofty equity valuations.

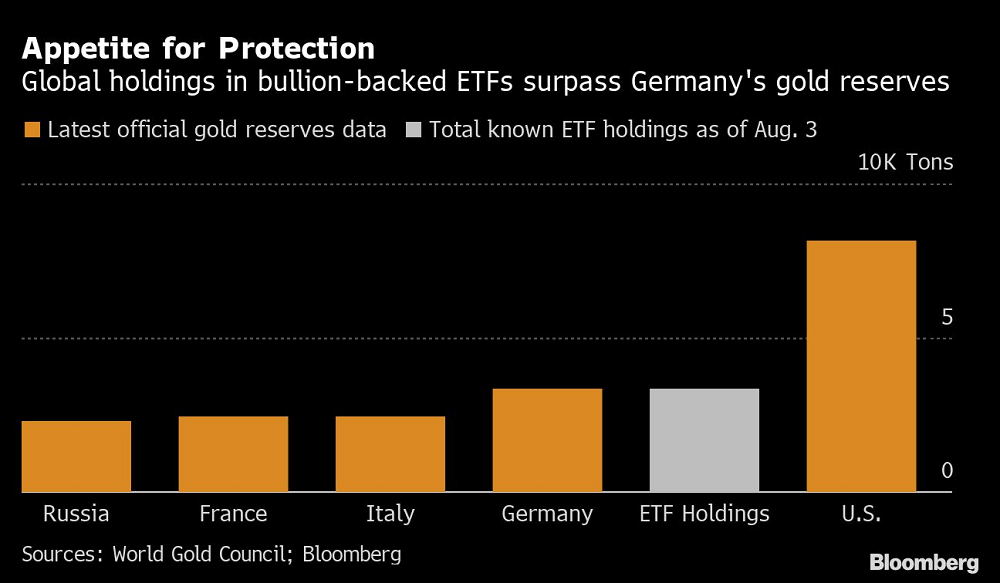

Worldwide holdings in gold-backed ETFs rose to 3,365.6 tons on Monday, up 30.5% this year, according to preliminary data compiled by Bloomberg. That’s a couple of tons ahead of Germany’s stash. U.S. reserves exceed 8,000 tons.

Even after futures topped $2,000 an ounce, there are plenty of forecasts for further, substantial gains. Among them, Goldman Sachs Group Inc. says gold may climb to $2,300 as investors are “in search of a new reserve currency,” while RBC Capital Markets puts the odds of a rally to $3,000 at 40%.

On Tuesday, futures traded at $1,993.20 an ounce, just below the latest record of $2,009.50, which was set on Monday. ETFs enable investors to trade in gold without needing to take physical delivery of the precious metal.

Gold ETF Holdings Are Booming and Only the U.S. Government Holds More, Bloomberg, Aug 4