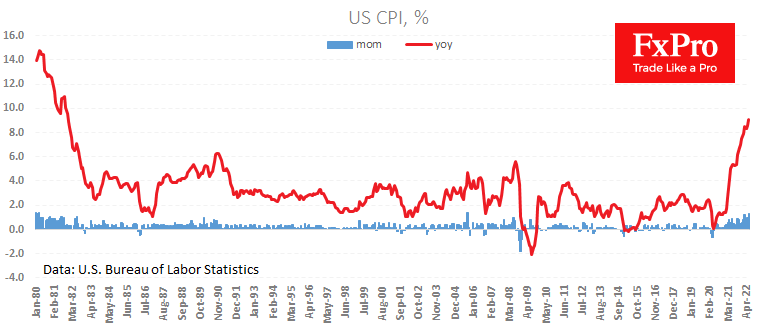

US consumer inflation hit a 41-year high and beat forecasts, reaching 9.1% y/y in June against 8.6% a month earlier and expected an increase to 8.8%. The data above expectations triggered a jump in the dollar and renewed pressure on risk-sensitive assets.

Speculation among traders increased that the Fed will have to do more than what is already priced in to catch up and suppress inflation. After the report, markets priced in two more 75-point rate hikes, while Powell called June’s hike “extraordinary”.

The initial market reaction triggered a retest of euro-dollar parity, but the single currency has so far managed to find demand at these levels. The same is true for other key currencies, which are running near local extremes against the dollar but successfully holding their ground.

Meanwhile, equities got a knock, with the Nasdaq index losing around 2% today and 3.9% from pre-release levels. Bitcoin has fallen below $19,000, returning to the lows of early July.

However, there is a sense that markets have jumped over their heads in their expectations from the Fed. Oil and industrial metals prices have been falling for about a month. The core inflation index, which does not include food and energy, has slowed for the past three months to 5.9% from a peak of 6.5% in March, although the monthly growth rate remains above the long-term average.

It would not be surprising if the Fed, after the 75-point rate hike at the end of July, were to reassure the markets that it would proceed more measuredly so as not to overcool the economy.

The FxPro Analyst Team